Global governance reform will be hard in the Trump era

Voting at international financial institutions does not reflect GDP trends, leaving emerging markets with little voice

Source: IMF, World Bank, OECD long term GDP forecasts, Oxford Analytica

Outlook

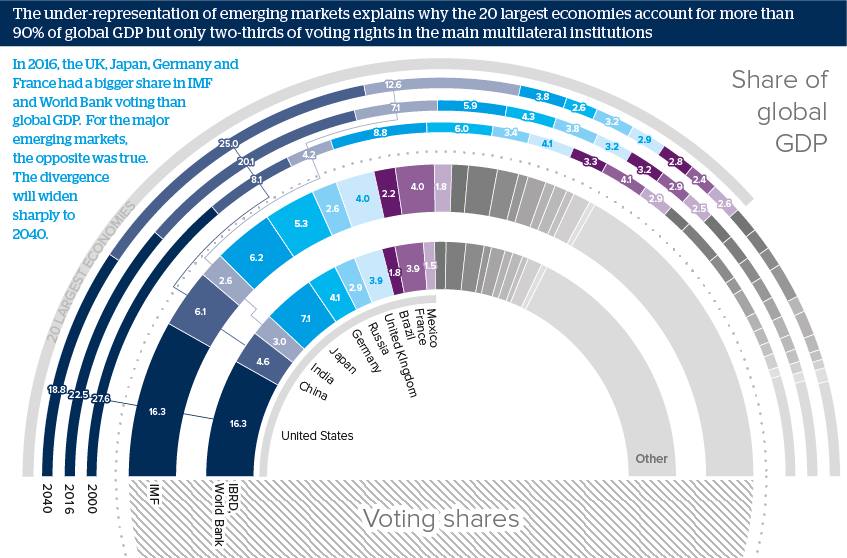

Although the Chinese and US economies are now of a similar dollar size, the United States has nearly three times more voting power in the IMF and nearly four times more voting rights at the International Bank for Reconstruction and Development (IBRD), the World Bank’s main lending arm.

In Western Europe and Japan, the share is consistent with global GDP. This is not the case in emerging markets, and the divergence will widen. By 2040, the OECD estimates that China and India will account for nearly 40% of global GDP, up from less than 30% now.

Voting is more balanced at the newer Asian Infrastructure Investment Bank (AIIB) and New Development Bank (NDB), but the World Bank and IMF have more lending scope.

Impacts

- Achieving reform will be difficult as the United States is retreating from multilateralism following the election of President Donald Trump.

- Should the US administration block a World Bank capital deal, emerging economies could desert the Bank and favour new alternatives.

- The potential financing capacity of the AIIB and NDB is more than 250 and 100 billion dollars respectively.

- The AIIB and the NDB will help achieve the 2030 Agenda for Sustainable Development and support global economic growth.

See also

- Compromises extend G20 cooperation amid little success - Oct 25, 2023

- Multilateralism risks will rise amid World Bank change - Jan 9, 2019

- Multilateral governance will advance despite obstacles - Apr 10, 2018

- Multilateral development banks pivot to private sector - May 19, 2017

- More graphic analysis