Prospects for manufacturing in 2020

The global downturn in manufacturing activity will persist and may deepen, weakening GDP growth prospects worldwide

Manufacturing directly accounts for 16% of global GDP, and for a higher share of economic activity in the major emerging economies than in most advanced economies. Manufacturing growth is expected to slow or contract in all industrial economies over the next twelve months, driven by the US-China trade tensions, faltering demand, consolidation and the disruptive impact of technology.

What next

Lower confidence and profits will erode capital investment, just as greater adoption of advanced technologies threatens the competitiveness of businesses that are unable to keep up with the pace of innovation. The downturn will be felt across global supply chains, affecting the materials, intermediate and capital goods, technology and services sectors. Indirect effects will aggravate the impact, especially in the most diversified economies.

Strategic summary

- Manufacturing-related job losses will intensify social tensions, and populist and protectionist pressures are likely to rise.

- The machinery and equipment sector will bear the brunt of lower capital spending.

- Collecting, managing and commercialising data will be key to manufacturers customising products and offering more value-adding services.

- Smaller manufacturers unable to keep up with the pace of innovation may be bought by larger firms; partnerships will become more common.

Analysis

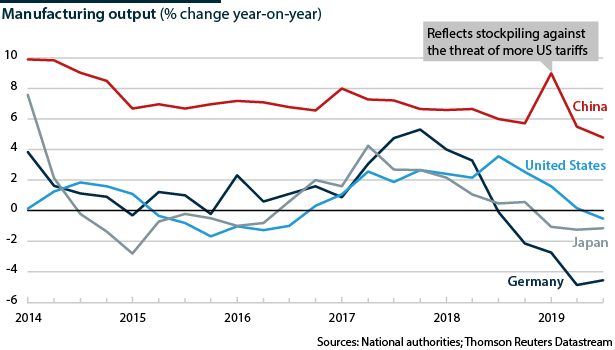

Global manufacturing value added increased by an annualised 1.7% in the second quarter of 2019, down from 2.2% growth in the first quarter of 2019, 3.2% in 2018 and 4.2% in 2017.

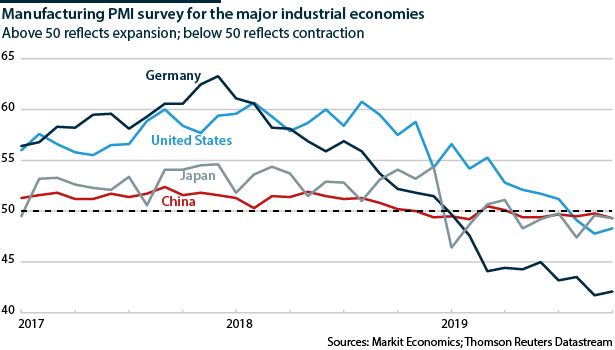

Manufacturing purchasing managers' indexes are at their lowest levels since 2012 in North America, the United Kingdom, the euro-area, Japan and the Asia-Pacific economies, suggesting that weak orders will constrain output well into 2020.

Meanwhile, financial ratings agencies expect flat-to-marginal growth in manufacturing earnings globally in 2019 and 2020. Only aerospace and defence are expected to outperform the overall average.

Little or no growth in world manufacturing output is likely in 2020. The IMF cited manufacturing weakness when it cut its global GDP growth forecast last month to 3.0% in 2019 and 3.4% in 2020 (see INTERNATIONAL: 2020 growth forecasts are unrealistic - October 17, 2019).

Market conditions

Global supply chains will communicate and aggravate the constraints that manufacturers are facing.

Trade

The disputes arising between the United States and China on the one hand, and the United States and the EU on the other, are causing tariff and non-tariff barriers to rise worldwide and heightening uncertainties about market access and business strategies (see US/CHINA: Tariffs may push a trade deal beyond 2020 - August 13, 2019).

Manufacturers are stockpiling goods and reconfiguring production systems and supply chains where possible to minimise risks. Manufacturers account for just under two-thirds of the world's trade in merchandise goods; this trade grew by a meagre 1% year-on-year in January-June, the slowest rate since 2012.

Investment

<2%

Global growth in real investment in January-June, a seven-year low

Real capital investment globally grew by less than 2% year-on-year in January-June, the slowest rate for seven years. Multinational firms are withholding investments amid the trade uncertainty, while public infrastructure investment is being trimmed by governments intent on reducing public-sector debt. More generally, lower demand and higher costs are eroding cash flows and confidence.

Capacity and wages

Consumption, particularly of durable items including cars and appliances, is slowing in the major economies. This is expected to continue.

Manufacturers of undifferentiated goods will face more downward pressure on prices, as consumer and capital spending growth slows worldwide and spare capacity rises in many countries, especially the advanced economies. In response, manufacturers are attempting to differentiate their products, processes and services, but claim that a shortage of skilled workers is raising labour costs.

Technology

Manufacturers are also struggling to manage the disruptions that are arising from the rapid development and use of advanced technologies.

Digitalisation

Digital technologies are increasing connectivity within factories and across supply chains, while sensors are allowing data from smart materials, products and platforms to be read and analysed.

A high proportion of the mainly larger manufacturers that are digitally transforming their operations have failed to meet their objectives in recent years. Either they failed to optimise their products and processes, or their people and processes were incapable of managing implementation profitably (see INTERNATIONAL: Weak GDP may delay ‘Industry 4.0’ plans - May 13, 2019). This should improve, but over years rather than months.

However, smaller manufacturers are slow to adopt technologies because of the initial costs and disruption, and the recent experience of larger manufacturers may further discourage them.

Cybersecurity

Cybersecurity threats are increasing, and in manufacturing are affecting not only the security of IT infrastructure, but also products and components.

Products and processes

Automotive manufacturers are increasingly focusing product and process development on electric vehicles, which require new designs, lighter materials and fewer parts.

Older models based on combustion-engine technology are being retired. Suppliers that are tied to those models or are unable to meet the more advanced parts-specifications that electric vehicles (EV) require will receive fewer orders. A significant number of assembly and parts facilities, many of them high-volume and highly efficient manufacturers of standard products, will close.

Additive manufacturing

The advance and increasing use of additive manufacturing technologies are beginning to disrupt the business of producing replacement parts. This will threaten business models and supply chains in the automotive and equipment sectors.

Artificial intelligence

Use of artificial intelligence will lead to greater autonomy in vehicles, other devices and automation systems. New jobs will be created in engineering and technology, but as autonomous systems are diffused more, the number of unskilled and semi-skilled manufacturing jobs will fall.

Plants

New facilities are being built to produce advanced technologies and devices. These tend to demand a smaller and higher-skilled workforce than traditional plants.

For example, the battery manufacturing plants that support EV manufacturing are highly automated. They will create employment for manufacturers of automation, but are unlikely to create many new jobs themselves (see INT: Redistribution is key to future of the workforce - May 25, 2017).

Structural trends

Technologies are driving the development of new products and services, production processes and business models. This is disrupting demand, business systems, structures and supply chains. In response, operations are being restructured, driving several structural trends.

The structure of firms and supply chains will change

Diversification

More manufacturers will offer value-adding services, along with cost-competitive, manageable products which can be delivered as needed, in order to differentiate themselves from their competitors.

Their ability to collect, manage and commercialise data will determine what services they offer and how far they can customise them.

Corporate consolidation

Mergers and acquisitions will increase, driving out non-profitable operations and suppliers. Larger manufacturers will acquire technology companies to strengthen their advanced manufacturing capabilities and augment their intellectual property portfolios.

Supply-chain consolidation

The economic downturn is threatening the viability of supply chains and production systems. Manufacturers will continue locating final-goods production and critical suppliers in key regional markets to minimise trade disruptions, but consolidation will occur in the production of lower-value commodity products, reducing the number of producers and suppliers in global supply chains.

Collaboration

The pace of advances and the disruptive nature of advanced technologies will see manufacturers collaborating more with researchers, tech start-ups and supporting-services firms.

Tech partnerships are common in product development and design, and will become more prevalent in the development, operation and maintenance of production systems.