Extended tariffs may push a US-China deal beyond 2020

The escalation of US-China trade conflict cuts the chance of a deal of any form being agreed before the 2020 US election

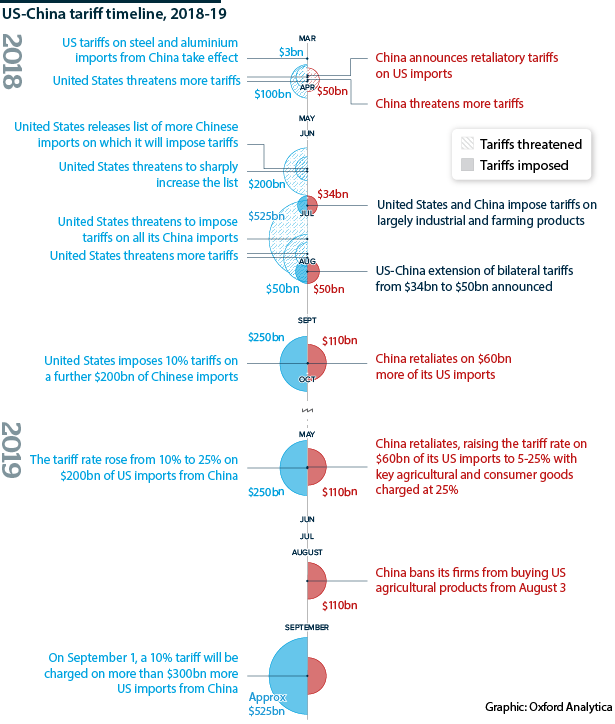

Starting on August 1, the United States and China have this month imposed more import tariffs on each other’s products following the collapse of the Shanghai round of US-China trade talks. The quick reaction by both indicates that neither sees much prospect of reaching a deal. To protect domestic activity and maintain momentum for further talks, both could apply a lower tariff to products they cannot buy from elsewhere. For example, rare earths, which the United States depends on China for, remain exempt from tariffs.

What next

The United States and China are unlikely to reach any kind of trade agreement in 2019 or even 2020 as neither is willing to make substantial concessions and both believe that their actions are a good response to the unsuccessful Shanghai meetings.

Subsidiary Impacts

- Worries about the overreliance on consumer spending and uncertainty over investment ahead suggest that the US downturn could accelerate.

- Despite suffering slower growth and employment worries, China will not simply agree a deal on the US administration’s terms.

- Chinese negotiators understand the US-China trade dynamics better than the US administration and will use this to their advantage.

- The US administration can impose 25% tariffs on its global imports of cars and parts, citing national security; this would hit the EU hard.

Analysis

Shortly after the Shanghai meetings ended without agreement, the US administration imposed tariffs on the remaining Chinese imports that had not yet been affected, excluding a very small number of categories such as rare earths. Beijing responded in kind, hitting imports of US agriculture and other products. The latest tariffs will harm efforts to improve relations until at least late 2020.

US economic downturn

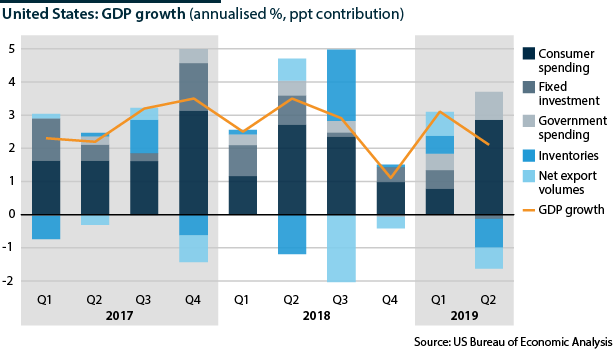

The US economy is heading into a downturn (see PROSPECTS H2 2019: Global economy - June 28, 2019). Employment is robust, as is GDP and other indicators that presidents enjoy touting as proof of success. However, fixed investment, net trade and stockbuilding subtracted from GDP in the April-June quarter and without consumer spending contributing the most in six quarters, GDP would have contracted.

Adjusted for inflation, wages have stagnated for 25 years, due to several factors but especially the push for publicly traded companies to prioritise stock value over other activities, weighing on consumer spending.

The yield curve, the spread of interest rates between short-term and long-term US Treasury bonds, is inverting. This historically signals a sharp slowdown in growth or even recession.

US misunderstandings

Perhaps the most significant problem facing the talks is the US administration's perception of the problems and solutions of US-China trade. The 2020 election is also being prioritised over economic stability.

Underlying dynamics

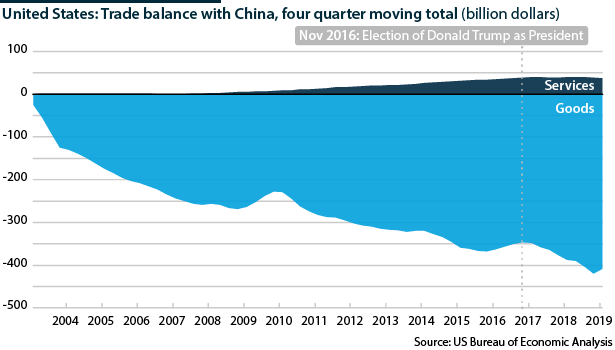

The administration is most concerned about the balance of trade, especially US manufacturing and exports. While this may appeal to certain voters in the industrial Midwest, it ignores the reality that trade balances are a crude comparative measure and that China is not a strong market for US manufacturing. This is partly because the Chinese economy has economies of scale for its own output, and partly because many US manufacturers have not followed Germany in adopting the smaller-but-better approach.

The US administration, and President Donald Trump in particular, seems to believe that the trans-Pacific trade dynamics of a decade ago still govern Chinese exports, notably labelling China a currency manipulator.

However, China only meets one of the three conditions that the 2015 Trade Facilitation and Trade Enforcement Act specifies for a manipulator -- running a trade surplus with the United States above 20 billion dollars.

Naming China as a manipulator may be a ploy towards the Trump administration's goal of reaching an agreement with Beijing before the 2020 election, but it is just as likely to have been driven by genuine misunderstandings by political leaders and a scepticism of technical experts who better understand Chinese trade dynamics.

Unpredictability

The administration is held hostage to the often-unpredictable decisions of Trump, especially irregular tariff impositions (see US-CHINA: Multi-front rivalry will persist - February 18, 2019). Dramatic statements might play well to Trump's rallies but do not inspire confidence among the business community.

When corporations believe the policy decision-making process to be mercurial, especially on such existential issues as whether to make capital and employment investments at home or abroad, they will shy away from investments, dampening longer-term growth (see INT: Intellectual property tension will intensify - April 19, 2018).

This is exacerbating structural weaknesses in US employment and real wages while also hindering manufacturing growth. At the same time, firms face pressure to maximise short term returns.

US policy uncertainty may push US multinationals towards investing abroad rather than at home

China and other competitors see this dynamic and offer the stability that these manufacturers seek, further weakening their US presence and driving US manufacturing imports higher.

Chinese weaknesses

GDP growth is slowing and, importantly for social stability, hiring is slowing, especially of China's growing population of well-educated would-be professionals seeking to move to Beijing or Shanghai (see CHINA: Rising risks threaten the steady GDP slowdown - July 17, 2019).

Investing in the Belt and Road Initiative is in the short-term helping Beijing to avoid a sharper slowdown. This anxiety about the importance of the economy remaining strong may be contributing to China's insistence on retaining majority control over foreign investment into the domestic economy, as well as insisting that corporations doing business in China hand over intellectual property as a cost of doing business there.

These actions do not play well abroad, especially the belief that China is stealing intellectual property. Domestically, these actions suggest that the Communist Party fears losing control of China's economy and people. Fear that a deal with the United States could hinder Beijing's ability to determine how to control its economy will discourage compramise on these policies.

Fear that a deal could reduce the control the Communist Party has over the economy will discourage China from agreeing concessions

Further strains on US markets

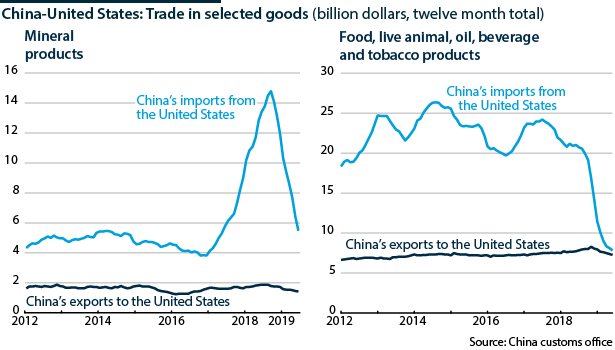

The US focus on manufacturing trade neglects two markets that may be bellwethers for the short- and medium-term dynamics of US-China trade -- agriculture and oil.

Agriculture

The United States remains a net exporter of agricultural products, and China remains a key market for these, including wheat and soybeans. Beijing has imposed tariffs on many US agricultural imports.

Not only does this hit the United States in a vulnerable spot, it could also have political repercussions. Farmers, especially independent farmers, have already suffered from the tariffs on Chinese steel, which have increased prices for their equipment. Higher tariffs on the agricultural commodities they ship to China will further squeeze them at home, with only minimal assistance from the Trump administration to offset this.

Although some agricultural districts in the Great Plains will likely still vote for Trump, enough voters may be dissuaded by Trump's tariffs that states such as Iowa, Ohio and Wisconsin may swing Democratic in the critical suburban/semi-rural communities (see UNITED STATES-CHINA: Tariffs - August 9, 2018).

Energy

US-China energy trade could go either way: it could be something they agree on but in the current climate is more likely to suffer tariffs

China buys its fossil fuels from across the world, some of it from the United States. China could offer to buy more US fossil fuels if it wanted to make a concession but in the near term, it is much more likely that Beijing will target oil for retaliatory tariffs. This might prompt Beijing to buy more oil from Iran, which is currently subject to increased US sanctions due to claims that Tehran is not abiding by the 2015 nuclear agreement.

Any effort on Beijing's part to increase its Iranian oil purchases will be met with hostility in Washington, worsening US-China relations. However, the Trump administration will have few, if any means to discourage Chinese-Iranian trade.