COVID-19 will hit US GDP but recovery may be V-shaped

The impact of the COVID-19 outbreak on financial markets, firms and households will sharply reduce second-quarter GDP

Before the COVID-19 outbreak, economic activity was growing at 2.0-2.5%, the stock market and employment were close to record highs, new home sales were rising and consumer spending had momentum. The immediate outlook for the US economy is now very unclear as the number of COVID-19 cases has surged above 3,800 and the virus is present in 49 states, prompting President Donald Trump to declare a national emergency on March 13. To bolster financial market liquidity and support businesses and households, the Federal Reserve (Fed) cut rates by 100 basis points to 0-0.25% on March 15.

What next

Many sectors will slow while the virus is present and workers and firms will come under severe pressure. GDP growth will slow sharply or contract in the second quarter of 2020, with business profits slowing or falling even more sharply. Both Congress and the Federal Reserve seem willing to do 'whatever it takes', and government programmes will be unveiled to try to limit the disruption. If new cases peak in the second quarter of 2020, the damage could be short-lived and the recovery strong.

Subsidiary Impacts

- The public spending for the COVID-19 outbreak will add to the budget deficit as no party is willing to raise taxes in an election year.

- The Fed may cut rates more but will risk inflation if rates stay low too long; if recovery is rapid, rates may rise sooner than expected.

- Heavily indebted firms and individuals will seek assistance from the government, especially in the travel and entertainment industries.

- A sharper economic downturn will test Trump’s managerial skill as his voters expect him to be able to resolve their problems quickly.

Analysis

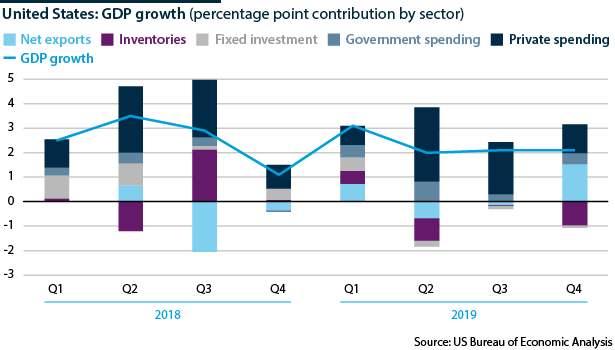

GDP has averaged growth of around 2.3% per year since 2009 and was likely to grow by 2.0-2.3% in 2020 and 2021. However, within the last seven days, the number of US cases of COVID-19 has surged from hundreds to more than 3,800 (see INTERNATIONAL: Pandemic declaration may be late - March 12, 2020).

US firms and citizens are reacting:

- by travelling less, as flights are cancelled to Asia and Europe (see INT: Coronavirus will hit tourism-driven economies - February 11, 2020);

- by engaging in less public activity as sporting events have been cancelled and far fewer people are dining out or attending entertainment; and

- by bulk purchases of supplies such as masks, hand gels and staple products that might be useful in the event of a lengthy quarantine.

The 2018-19 flu season led to around 35 million illnesses, 500,000 hospitalisations and 35,000 deaths (the large majority aged over 65). Around 45% of the adult population was vaccinated against it and just over 10% of the US population caught it. While this disease infected millions and killed tens of thousands, US GDP still grew by around 2.3%.

COVID-19

Coronavirus is different from the flu -- there is no vaccine and it might affect more people with more lethal outcomes. The president is suffering from persistently low approval ratings and there is widespread scepticism about whether the government will handle the outbreak well. Large numbers of US citizens have been in airports or other locations with people who have been in China and Europe and so may have been exposed to the disease (see INT: Preparedness and trade affect COVID-19 exposure - March 3, 2020).

Parts of the United States are densely populated, including the large metropolitan areas on both coasts. Seattle, Washington and New York have been hit hard. Trump won mostly in the far less densely populated southern and central states in 2016 and self-isolation will be easier in these states.

Densely populated urbanised coastal areas are vulnerable to COVID-19; more people there vote Democrat than Republican

Employment

US workers are especially vulnerable due to the nature of the healthcare system. Salaried workers worldwide are usually entitled to sick leave, but there is no requirement for US firms to offer sick leave to all workers. Fast-food restaurant workers who feel unwell may have to decide between not being paid and possibly infecting customers and other workers.

Spending

Cancelled spending, for example not buying coffee or lunch out because one is quarantined, will not be made up. Delayed spending, such as postponing construction project might be cancelled or reduced, might be restarted or might be increased.

Travel and hospitality

Resident and non-resident travelers spend more than 1 trillion dollars travelling each year. Many institutions are recommending that employees do not travel and many individuals are cancelling holidays. Sharply lower travel spending will result in airlines and the restaurant and hotel sector shedding jobs, as well as the employees that are retained working, and being paid, for fewer hours.

Essential and discretionary consumption

The Bureau of Labor Statistics estimates that the discretionary part of consumer spending that would be unspent in such a crisis would include -- food away from home, apparel, fuel for transportation, entertainment, personal care and some of the 'other' category, coming to 15% of households' budgets. Payments on rent, mortgages and insurance are mandatory, as are other bills and essential food and drink. Consumer spending is around two thirds of GDP and if 15% of spending is at risk, this is equivalent to around 10% of GDP.

~10% of GDP

Discretionary consumer spending that could be cancelled or delayed

Government

Government spending, including federal, state and local expenditure, is around 18% of GDP. This will increase as programmes will be established to help areas suffering from the disease.

Investment

Investment, which accounts for much of the rest of GDP, is likely to be postponed but most will probably not be cancelled.

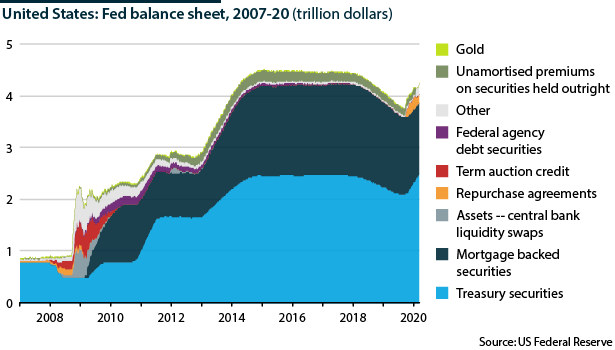

Monetary policy

The Fed is taking the lead in the policy response, cutting rates by 50 basis points (bp) on March 3 and then by 100 bp to 0-0.25% on March 15. It has added 1.5 trillion dollars of liquidity to financial markets this month and is indicating that it will buy at least another 500 billion dollars of treasury bills and 200 billion dollars of mortgage-backed securities this year.

Individual banks (of which there are more than 4,000, some very small) will also be able to access extra funds through the discount window in the event of cashflow problems. The central bank has also cut reserve requirements for thousands of banks to zero, meaning that financial institutions will be able to use funds that they previously had to hold in reserve.

The Fed has indicated that more cuts will be forthcoming if needed. It might also introduce measures to encourage banks to be patient with small business customers, as well as with large firms in exposed sectors such as travel (see INTERNATIONAL: COVID-19 will worsen the industrial dip - March 13, 2020).

Housing activity

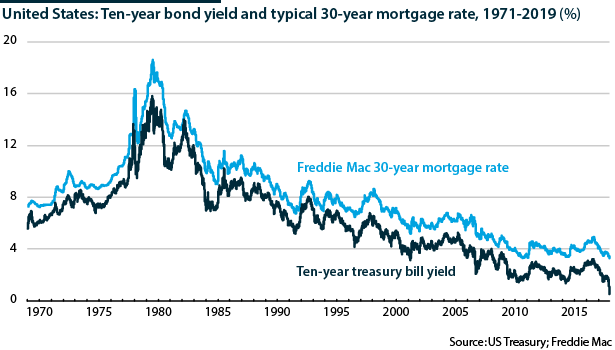

The ten-year benchmark treasury bill yield has fallen below 1% and the 30-year fixed rate mortgage rate has fallen to an all-time low of around 3.5%. More homeowners will refinance at lower rates, increasing their spending power. If the COVID-19 outbreak persists into the second half of 2020, lower rates will increase demand for housing among those whose employment is secure. Prior to the COVID-19 outbreak, housing market activity had been beginning to increase after being subdued for much of the last ten years.

Government responses so far

On March 14, the Democratic-led House of Representatives passed a bipartisan bill, with just 40 votes against, that if passed into law would require two weeks of paid sick leave for public sector workers and private sector workers in firms with fewer than 500 people. The scheme would run for one year.

The bill would also include three months of paid leave in cases of quarantine (pay set at two-thirds), or cases where children need out-of-school care. School children normally in receipt of food aid would also get additional support. Meanwhile, states would receive funds to tackle COVID-19-related job losses and free COVID-19 testing would be made available nationally.

The Republican-led Senate will take up consideration of the bill this week. It is likely to pass the measure, but Republicans are concerned about any undue burden on small businesses from having to pay sick leave costs. It is therefore likely that the Senate will insert relief measures for small businesses before passing the legislation, to mitigate the cost to them of providing sick leave pay.

Trump is unlikely to baulk at the legislation, especially as he has tied his political fortunes to the performance of the US economy and stock market. Congress and the White House will devise further economic stimulus packages in coming weeks. These will likely entail tax rebates, reductions or stoppages, and loans, grants or both, perhaps targeted by economic sector and industry.