ECB may extend QE to support recovery

Weaker-than-expected global growth may dampen euro-area recovery, requiring further monetary stimulus

Updated: Oct 23, 2015

Source: Eurostat, ECB, Bloomberg consensus forecasts, Oxford Analytica

Outlook

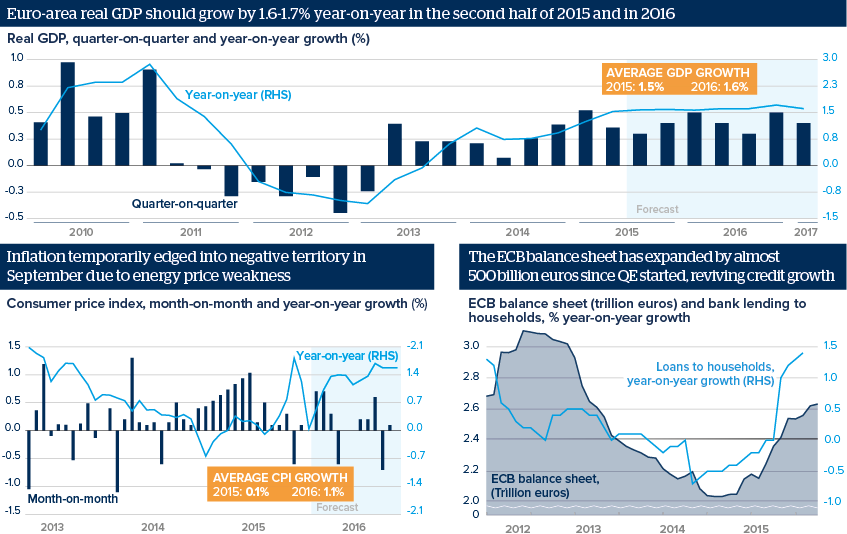

The euro-area business cycle momentum remains positive and resilient to external headwinds. Growth in the second half of 2015 and in 2016 will be supported by low energy prices, euro weakness and the positive impact of loose monetary policy on bank lending, and thus consumption and investment. In the medium term, subdued wage growth and ongoing deleveraging by banks, corporates and households weighs on the outlook. Markets seem likely to absorb any possible future political uncertainty in Spain, Portugal and Greece.

Headline inflation will rebound before year-end due to base effects, while core inflation (excluding food and energy prices) will accelerate slowly. The ECB stands ready to act if the inflation outlook weakens further, although a quantitative easing (QE) programme extension looks premature at the October 22 meeting.

Impacts

- Growth may exceed expectations if the QE impact on domestic demand proves stronger than anticipated.

- The QE extension could be unveiled at the December ECB meeting if the US Federal Reserve looks set to keep interest rates on hold.

- The QE extension is likely to envisage both higher monthly bond purchases and an extension beyond the current September 2016 end-date.

- The ECB might cut interest rates further, although this is less likely.

See also

- ECB will extend QE programme on December 3 - Dec 1, 2015

- Prospects for the euro-area economy in 2016 - Nov 3, 2015

- Prospects for the global economy in 2016 - Nov 2, 2015

- ECB set to prolong QE programme in December - Oct 23, 2015

- Euro-area growth to pick up after mild setback - Aug 18, 2015

- More graphic analysis