Prospects for the global economy in 2016

Global trade and growth will be subdued as commodity sell-off continues to hit emerging economies

Updated: Apr 18, 2016

IMF meetings focus on global structural reforms · All Updates

Adverse trends visible across many regions at end-2015 suggest that global growth will stay subdued in 2016. Leading international institutions forecast an upturn in activity, but also emphasise obstacles and risks ahead. They encourage efforts to support growth prospects. However, little has been done so far regarding infrastructure investment, structural reforms and other pro-growth policies except for the ECB considering a boost to its quantitative easing (QE) programme.

What next

Monetary policy will remain in the spotlight in 2016, especially regarding the expected US Federal Reserve (Fed) decision to raise official interest rates. The first step may come in December 2015 and more rate rises are likely next year. While the Fed will tighten, the ECB is likely to expand the size, composition and duration of its QE programme. Budget trends may become more troublesome in 2016, but the ECB's more accommodative policy stance could boost growth prospects. Bond yields will rise mildly in most developed countries in 2016. The dollar will enjoy renewed strength while the euro and the yen will be weighed down by QE extensions.

Strategic summary

- A reduction in geopolitical risk could boost both short-term and long-term growth prospects.

- Recovering commodity demand would also support growth, but this is unlikely, especially without a 'peace dividend'.

- Chinese authorities' possible success in stabilising growth would only limit the commodity sell-off, not reverse it.

Analysis

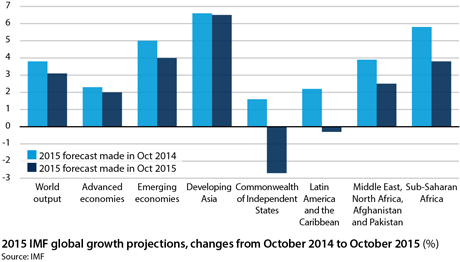

Current trends offer no indication that the global economy will accelerate much in 2016. Both the latest data and revised estimates from international institutions point to global GDP and trade growth only slightly above 3.0% in 2015 (see PROSPECTS Q4 2015: Global economy - September 2, 2015). Throughout the past year, the IMF has gradually downgraded its 2015 global growth forecast. The same is likely to happen with its 2016 forecast. The reasons for the latest forecast failures reveal the depth of the current crisis in many regions.

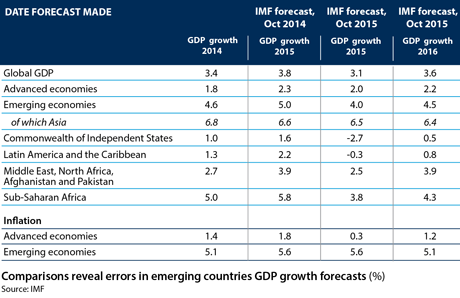

In October 2014, the IMF predicted 2015 global growth at 3.8% (see INTERNATIONAL: Global economy will face new mediocrity - October 9, 2014). The outcome is now estimated at 3.1%. Advanced economies' growth has slightly disappointed, around 2.0-2.5%. However, they are not the key swing factor behind the forecasting errors.

The critical factor is that the IMF's estimate for emerging countries fell from 5.0% to 4.0% over the past year. Despite the downward revisions and current weak trends, the institutions' forecasters predict a rosier 2016 outlook. Both the WTO and the IMF suggest a marked upturn in GDP and trade growth next year, unlikely to materialise. An upturn may be possible under favourable changes in economic and geopolitical conditions, but the most likely scenario is persistent weakness.

3.1%/3.6%

IMF real GDP growth projections for 2015 and 2016The IMF's 2016 global growth forecast is almost unchanged from a year ago, at 3.6% versus 3.7% in October 2014, with the emerging economies predicted to accelerate to 4.5%. Developing countries' recessions have worsened in the second half of 2015 and they will struggle to stabilise, let alone improve, their growth prospects in early 2016.

There has been greater stability -- and accuracy -- in forecasts for developing Asia and, within this, for China. Errors seem to be linked to worse-than-expected recessions caused in other developing countries by the commodity sell-off and geopolitical risks (see INTERNATIONAL: Commodities rout will fuel EM concerns - August 4, 2015).

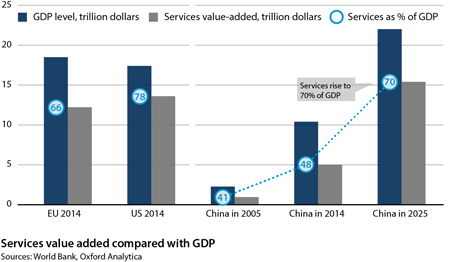

China remains a key swing factor for commodities. The country itself is not in crisis nor behaving unpredictably. It appears comfortable with the transition to more moderate growth and a stronger focus on domestic consumption and services, in an attempt to rebalance its growth model (see CHINA: Data doubts may muddle decision-making - October 19, 2015). However, this rebalancing curbs commodity consumption; weak Chinese imports affect commodity exporters.

Growth and stability zone?

Both the United States and the EU are enjoying relatively stable, even if subdued, growth despite weakness in other areas. China also has relatively strong growth, even if slowing, together with the financial security provided by its large international reserves and the growing role of the renminbi in the global monetary system (see INTERNATIONAL: Dollar to stay as main reserve currency - October 8, 2015). Between them, these three areas account for more than 60% of global GDP, according to World Bank data, and a substantial, even if smaller, share of global exports (around a third), a large part of which is with each other.

Unlike small open economies, these economic giants have large internal markets and are relatively closed, which means that trade is a rather small share of their GDP. They may form a self-sustaining system providing support against external turbulence. This would help them keep growth stable, at a high enough rate to maintain or add jobs.

The general lack of interest in new policy initiatives in developed countries is in part because their economies have so far shown resilience despite stagnant global trade and a poorly performing emerging world. Major economies need to ensure they remain immune to the threats posed, including contagion and the risk of global instability.

Fiscal austerity has been toned down in the euro-area, with issues and expenditure related to the migrants emergency adding to pressure to reset priorities (see EURO-AREA: Fiscal policies will not find common ground - October 29, 2015). Germany would not otherwise have countenanced a potentially stimulative fiscal package.

Emerging world and commodity producers

Emerging countries' growth prospects remain subdued for 2016. Commodity producers have taken a hit from lower prices in 2015. They should be able to cope better in 2016.

6.9%

China's third-quarter year-on-year real GDP growthChina's growth remains strong despite slowing. GDP grew a better-than-expected 6.9% year-on-year in the third quarter after 7.0% in the previous quarter. However, the slowdown in the economy's growth and demand expansion will not reverse significantly. This offers only moderate opportunities for those global sectors dependent on a strong growth rate in China, such as commodities, which will see virtually no sales expansion.

New markets such as India (where yearly GDP growth was 7.25% on average in the first half of 2015) are growing rapidly and opening up. They could partially fill the void left by China's transition. However, it will take several years for this to have a sufficiently strong effect to support energy and commodity markets.

Growth in the commodity economies remains under pressure at end-2015, as indicated by the weak second-quarter GDP figures reported by Russia, which showed a larger-than-expected 4.6% year-on-year contraction. Some countries have yet to reveal the full extent of the damage wreaked by the commodity price slump, as data are slow to emerge. Regional forecasts will see more downward revisions.

Barring another negative shock, energy and commodity prices look to be over the worst, especially as seasonal demand comes back. This suggests that actual conditions in the worst-affected countries should start to stabilise, but it does not promise an early recovery.

Bond markets

Global bond markets have seen high volatility and no clear trends in 2015. In the first quarter, the extension of Japan's qualitative and quantitative easing (QQE) programme and the launch of the ECB sovereign QE programme set the conditions for a sharp drop in global yields, pushing the ten-year Bund (German government bond) yield to an all-time low of 0.05% on April 17. Then, due to abundant liquidity, growth and inflation expectations accelerated, causing a widespread rally in global yields.

In the second half of 2015, China's slowing growth, the commodity sell-off and the intensifying turmoil in several emerging countries exerted renewed downward pressure on advanced economies' government bond yields. They are now close to levels seen in early 2015 in the United States, Japan and in both core and peripheral euro-area countries.

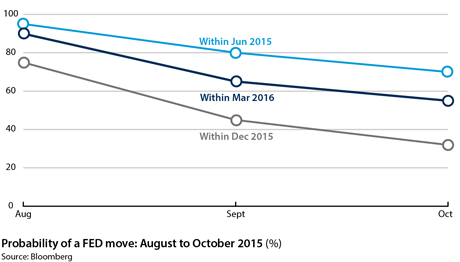

A modest rise in yields is likely for most developed countries in 2016. The Fed is close to starting a normalisation of monetary policy to limit the negative side effects of a long period of exceptional monetary stimulus. An easing of tensions in China and other emerging countries may allow the Fed to start tightening as early as December.

Central-bank liquidation of fixed income assets, as currency reserves have been drawn down due to recent capital outflows, will drive up global yields. The outflows have reversed the flood of liquidity that surged into emerging countries during the Fed's QE programmes.

United States

50%

Current chance of a December rates lift-offDue to a hawkish Fed statement on October 28, the market now discounts a 50% chance of a December rates 'lift-off'. Overall, only a couple of 25 basis-point (bp) hikes are anticipated by end-2016, although this forecast could change rapidly through 2016.

The start of the policy normalisation process will weigh on the term structure, possibly driving the ten-year Treasury yield up to 2.7-2.8% in the first half of 2016. Renewed dollar strength should temper inflation expectations in the second half of the year, allowing the benchmark yield to settle around 2.5%.

Euro-area

Despite supportive domestic fundamentals, growth and inflation forecasts have dropped due to weaker external demand and low commodity prices. The ECB has stressed that significant deterioration in the inflation outlook or additional tightening in financial conditions would warrant further monetary stimulus (see EUROPE: ECB may extend QE to support recovery - October 20, 2015). These conditions are likely to be met before its December meeting, allowing for QE extension in size, composition and duration.

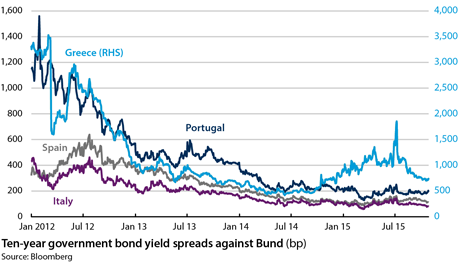

Euro-area government bond markets are already pricing in this outcome and the scope for core rates to fall further is limited. The negative deposit rate and ECB asset purchases will keep rates up to the five-year maturity low while the long end of the yield curve could react to a rebound in inflation expectations and rise alongside the US curve, probably allowing ten-year Bund yields to reach 1.0% in the second half of 2016. QE will be more effective in pushing peripheral yields down, with ten-year spreads against the Bund likely to fall below 100 bp for Italy and Spain.

United Kingdom

Commodity-driven disinflation coupled with growth moderation allowed the Bank of England (BoE) to delay its first rate rise. Inflation is likely to rebound before year-end due to base effects while a tight labour market will drive accelerating wage growth.

The first policy rate hike is likely in the first quarter of 2016, possibly in February, exerting a mild upward pressure on the yield curve, as the front end is pricing in a prolonged period of unchanged rates. The first hike is fully priced only towards end-2016. Ten-year Gilt yields are likely to rise to 2.2-2.3% in the first half of 2016.

Corporate bonds

Credit performance has been poor in 2015, both in Europe and the United States, due to the impact of the commodity sell-off on the basic resources and energy subsectors, together with the June-August spike in equity volatility (see UNITED STATES: Energy bonds spur default risk - March 19, 2015). Furthermore, the market has struggled to absorb heavy new supply, as companies issued new debt to benefit from very low yields.

Due to recent credit weakness -- both investment grade and high-yield spreads versus government bonds have increased markedly -- some value has returned to the US credit sector. However, it remains vulnerable to outflows, driven by tighter US monetary policy, and to the risk of rising default rates, especially in the energy subsector. US credit spreads should remain stable or widen slightly in 2016.

The picture is different in Europe, where credit metrics will benefit from the moderate economic recovery, and the ECB QE will underpin narrower spreads. Spreads could tighten materially, especially for financial issuers, thanks to improving balance sheets and a dearth of supply.

Emerging market public and private debt should experience further weakness due to deteriorating fundamentals and persistent capital outflows (see INTERNATIONAL: EM corporate debt is key vulnerability - October 13, 2015).

Currencies

In 2016, global forex markets will be driven by monetary policy trends.

The dollar

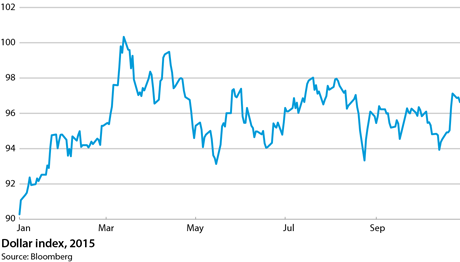

The delay in the Fed's lift-off, coupled with long portfolio positioning towards the greenback, led to a pause in the dollar's rally in mid-2015. The consolidation was helped by disappointing macroeconomic evidence, particularly in the manufacturing sector, with many firms mentioning the currency's strength as a headwind for their business.

By end-2015, this pause will be over. The start of US rates normalisation, together with a more balanced portfolio positioning and smaller dollar overweight, should push the dollar up again. As US yields will decouple from general trends in global rates, portfolio flows should soon become supportive. The dollar will be particularly strong against those currencies whose central banks have engaged in extraordinary stimulus measures or are about to expand them.

The euro

After a significant depreciation in early 2015, the single currency has edged higher despite QE. The Fed's lift-off delay and growing risk aversion played a role in this rebound. As many investors had sold the euro abundantly ahead of the QE launch, the shocks that occurred in mid-2015 triggered waves of short covering.

The euro will weaken towards parity against the dollar

If the ECB extends its QE programme in December, capital flight will accelerate once again, driven by fixed income portfolio outflows in search of returns abroad. In spite of the euro-area's strong current account surplus, such capital flows imply that the euro is likely to resume its downward trend, edging towards parity against the dollar in early 2016 and remaining broadly stable for the remainder of the year.

The pound

If the BoE raises rates in the first quarter of 2016, the pound will mostly be able to withstand the dollar's strength. The pound-dollar exchange rate ('cable') should drop only slightly to 1.46 in 2016. That translates into a euro-pound cross-rate of around 0.68.

The yen

The same forces that drove the euro in 2015 apply to the yen, despite even larger asset purchases by the Bank of Japan (BoJ). The yen is likely to resume its downtrend in 2016, helped by a likely further expansion of the BoJ's QQE programme.

Also, pension funds and other institutional investors are diversifying their investments towards foreign assets. This will keep the currency under pressure, especially in the absence of a significant current account surplus. The yen-dollar exchange rate is likely to reach 130 next year.

_350.jpg)