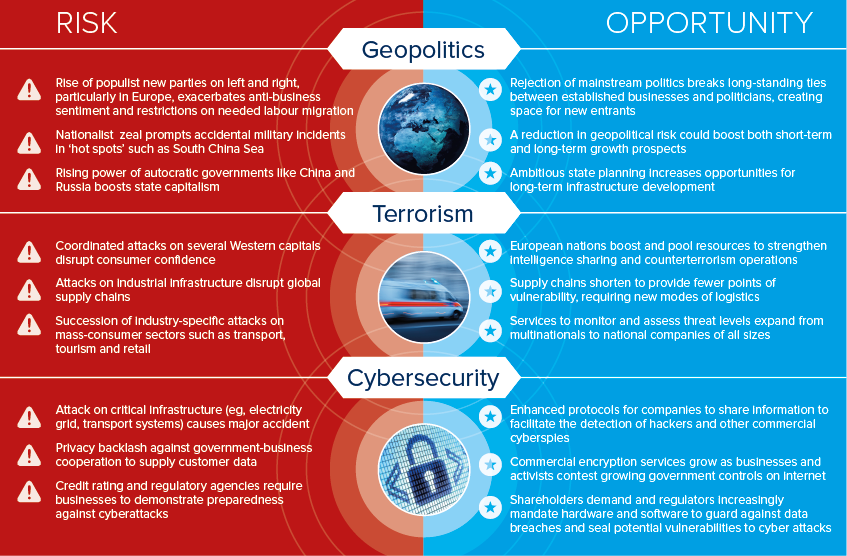

Key risks and opportunities in 2016: 1

The new year promises geopolitical complexity and volatility for businesses and investors alike

Source: Oxford Analytica

Outlook

Business and investment risk drivers will not diminish in 2016, but they will be secondary to growing political- and policy-driven risks. The increasingly critical struggle against Islamic State group (ISG) and Russia's military resurgence -- highlighted through terrorist attacks and Moscow's interventions in Syria and Ukraine -- are set to dominate, along with China's growing presence as a geopolitical power.

The other concerns of the year will centre on the US Federal Reserve's 'normalisation' of monetary policy, the future of the European Union 'project' and China's political capacity to drive through economic rebalancing in the face of slowing growth.

The main economic damage of all these risks will probably be to drain confidence in developed nations' ability to sustain economic recoveries, particularly in the event of terrorist attacks, and in developing economies' ability to deal with large capital flows.

Impacts

- Heightened political risk will fuel concerns about a slowdown in global growth and discourage investment intention.

- Emergence of non-mainstream political parties in Europe and the United States may peak, but party politics will remain highly fractured.

- Military procurement needs will change as nations combine conventional forces with expanded cyber-defence and intelligence capability.

- China's tighter control of information on national security grounds will further spill over to business, to foreign firms' disadvantage.

See also

- Key risks and opportunities in 2016: 2 - Dec 31, 2015

- Prospects for security and defence in 2016 - Nov 18, 2015

- More graphic analysis