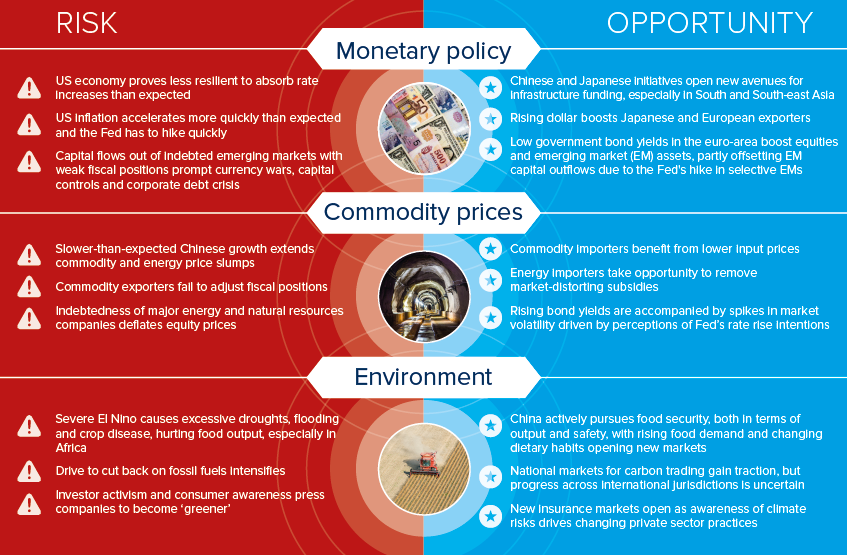

Key risks and opportunities in 2016: 2

The pace of US monetary policy normalisation and China's slowdown will be key determinants of 2016 growth

Source: Oxford Analytica

Outlook

The US Federal Reserve (Fed)'s raising of interest rates at end-2015 will make capital flows volatile in 2016. However, the impact of that volatility will vary greatly between countries, particularly in emerging markets (EMs). Much will turn on the pace and size of rises imposed in the coming year.

The global economy will remain vulnerable to downside shocks, such as China's economy slowing faster than expected. Fragile consumer and business confidence in developed economies will probably continue to dampen the appetite for infrastructure investment and structural reforms.

The dollar will strengthen as the Fed tightens, but further quantitative easing will keep the euro and yen weak.

Impacts

- Bond yields will rise mildly in most developed countries in 2016.

- Fiscal austerity will be toned down further in the euro-area in the face of the migration crisis and terrorism threats.

- The energy and commodity sell-offs will be past their worst, but stabilised growth in China will limit, not reverse them.

- Global trade and growth will remain subdued, as emerging economies adjust to the new price levels.

See also

- Key risks and opportunities in 2016: 1 - Dec 29, 2015

- Prospects for the global economy in 2016 - Nov 2, 2015

- More graphic analysis