Italy’s fragility is Europe’s biggest risk into 2018

Elections must be held by May 2018, against a backdrop of subdued growth prospects, indebted banks and rising refugees

Source: Bank of Italy, Bank for International Settlements, IMF World Economic Outlook, UN Refugee Agency

Outlook

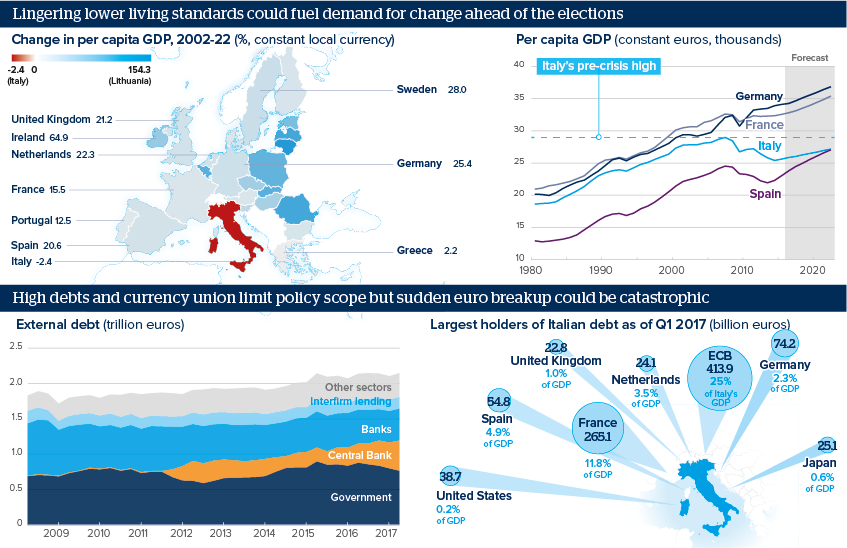

Italy’s per capita GDP has fallen by more than 10% since 2007. Moreover, medium-term growth prospects are modest, as rising debts limit investment and leave Italy vulnerable to the ECB tapering its quantitative easing.

Most sea migrants to Europe reach Italy’s 7,600-kilometre coast first. This year, 99,742 migrants have arrived, ten times as many as to Spain. Furthermore, two-thirds of these went to Sicily, where youth unemployment is more than 50%. Only 8,403 have been relocated, 21% of the government’s 2017 target.

There is election talk of Italy dropping the euro but the contagion from sudden euro-area breakup could be catastrophic. Italy would likely default on the 413.9 billion euros it owes the ECB. Shared out among others, this would cost nine countries more than 5% of their GDP.

Impacts

- GDP grew by 0.4% in the second quarter, providing a favourable environment to tackle non-performing loans of nearly 200 billion euros.

- All Italy’s political parties except the Democratic Party have considered euro exit and parliament mentioned it for the first time in July.

- Setting policy to escape both the low growth ‘status quo’ and the risk of a financial crisis is key to boosting long term prospects.

- EU banks could have to raise as much as 1 trillion euros of new debt to meet MREL requirements, depending on the final details.

- Italy is Europe’s second-largest manufacturer and one of its wealthiest countries, underpinning continued ECB support.

See also

- Italy’s Conte may not succeed in fighting poverty - Jul 18, 2018

- Prospects for the global economy to end-2018 - Jun 1, 2018

- Higher inflation will complicate the ECB’s conundrum - May 31, 2018

- Italy’s high bond spreads raise European banking risks - May 30, 2018

- Subdued inflation attenuates bond market strains - Jan 30, 2018

- The global economy will enter new era - Oct 4, 2017

- Italy’s growth outlook will be subdued without reforms - Oct 2, 2017

- ECB faces multiple challenges in withdrawing stimulus - Sep 18, 2017

- Italy's banks face twin test - May 30, 2017

- More graphic analysis