Policy and technology are key to full financial access

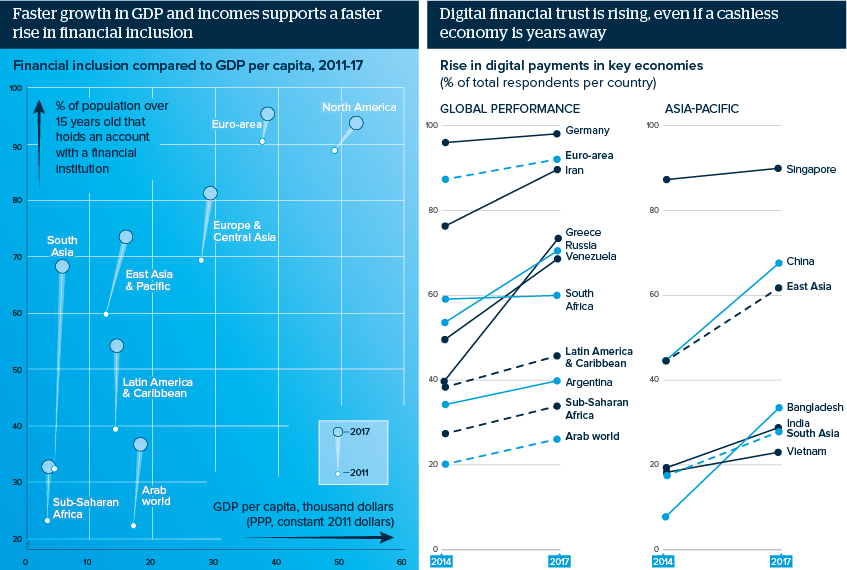

Nearly 70% of all over-15s are ‘banked’; at least 76% of them have also made a digital transaction

Source: The Global Findex Database 2017 and World Bank; Oxford Analytica

Outlook

The 1.7 billion over-15s that lack formal financial services access are disproportionately women, concentrated in only seven developing economies, poor, out of the labour force and lacking in educational attainment. A strong policy push involving a judicious use of affordable technologies can quickly lower barriers to financial inclusion, as it has in India and Bangladesh for example, given that about two-thirds of all unbanked adults have a mobile phone and about a quarter have both a mobile phone and internet access.

Trust is gradually rising in online financial tools, reflected in the rise in digital transactions worldwide (including in less advanced euro-area economies such as Greece). This will further enable countries to leapfrog technologically, in turn strengthening public trust in formal financial systems, narrowing public welfare leakages and reducing corruption.

Impacts

- The steady rise in digital payments justifies rising corporate investment in integrated online retail services.

- Growing data privacy concerns in emerging economies raise reputational and financial risks for firms with weak cybersecurity.

- Strong growth will enable East, South and South-east Asia to fund the physical and social infrastructure for financial inclusion.

- Slower-growing Latin America and Africa will see slower gains, but inclusion can transform more remote regions.

See also

- South-east Asia's fintech ecosystem is growing - Oct 12, 2018

- Policy will be key to supporting cashless consumption - May 4, 2018

- More graphic analysis