US auto autarky ambition could cut world trade and GDP

The EU taxes US cars at 10%, firing an auto surplus; the US taxes EU cars at 2.5%, firing a deficit and troubling Trump

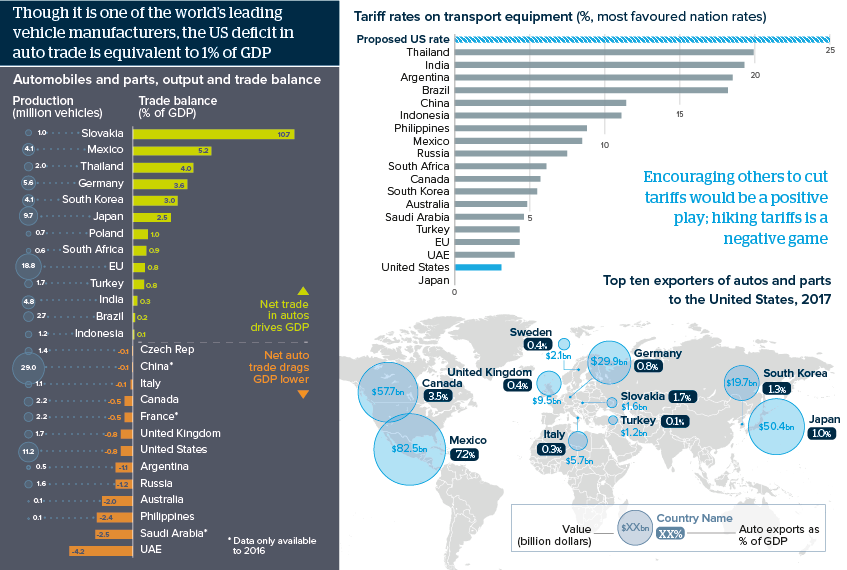

Source: UNCOMTRADE database, WTO tariff database, IMF World Economic Outlook database

Outlook

US President Donald Trump threatens to impose 20-25% tariffs on US imports of cars and parts, as negotiators investigate whether such imports can be restricted on the grounds that they put US national security at risk. Regardless of the validity of this claim, moving towards auto self-sufficiency suits the Trump administration’s aim of re-establishing US manufacturing jobs.

Auto trade is relatively less important for US growth than for many countries. China’s auto trade is balanced. India and Indonesia run small surpluses, but rising demand will reverse this. In 2005, China and Japan bought 9% of all vehicles sold worldwide. China’s share is now 30% and Japan’s is 5%.

Impacts

- Jaguar Land Rover has no US plants to move output to; others will also struggle -- BMW imports 50%+ of its US sales.

- Costs could soar for manufacturers and consumers; Toyota and Nissan sell over 20% of their Japan-made vehicles to the US market.

- US firm Harley-Davidson is moving some of its US output to miss the US-EU tariffs and is building a new Thai plant -- others could follow.

- The Peterson Institute finds a 25% tariff on vehicles and parts imports would cut US car output by 1.5% over 1-3 years, losing 195,000 jobs.

- Globally, softening the job losses, more robots and less workers are being used.

See also

- Firmer forecasts for 2020 world growth are unrealistic - Oct 17, 2019

- Prospects for the global economy to end-2019 - Jun 28, 2019

- Long-term challenges will slow Germany’s economy - Feb 26, 2019

- Ford’s plan to revive its European profits faces risks - Jan 10, 2019

- Prospects for the global economy in 2019 - Nov 30, 2018

- Domestic factors will weigh on Central Europe’s autos - Aug 29, 2018

- Automobile anxieties will rise amid ‘green’ transition - Jul 9, 2018

- Fragile Canada-US relations could fracture further - Jul 5, 2018

- Prospects for the global economy to end-2018 - Jun 1, 2018

- More graphic analysis