Pride and politics will push Turkey to recession

A sudden deterioration in US-Turkish relations has plunged Turkey into a debt and liquidity crisis

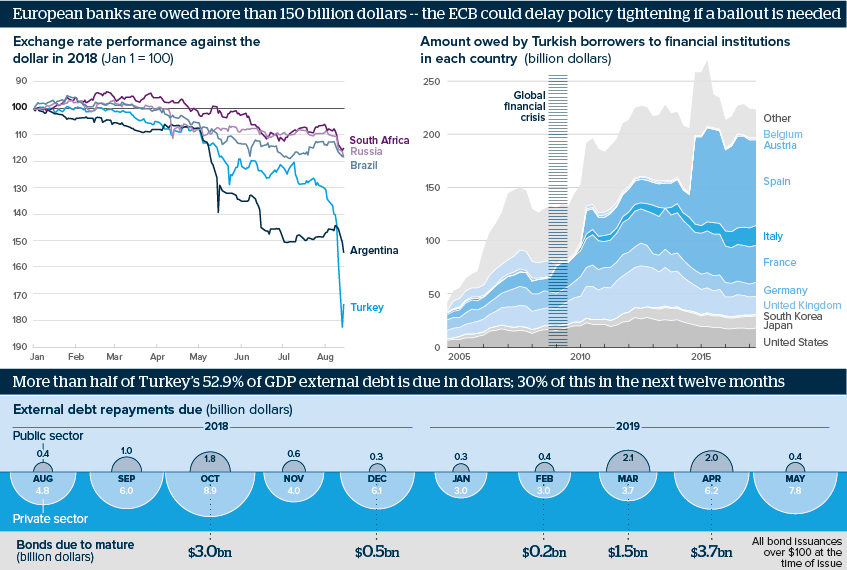

Source: Bank for International Settlements; Central Bank of Turkey; Turkish Ministry of Treasury and Finance; Thomson Reuters Datastream; Oxford Analytica

Outlook

President Recep Tayyip Erdogan is taking an increasingly defiant stand, imposing tariffs on imports of US cars, cigarettes and alcohol and recommending citizens replace their iPhones with non-US phones. The situation has deteriorated beyond being reversible by raising interest rates. Approaching the IMF looks out of the question.

Capital controls are being mooted. They would stop savings escaping abroad, but they would not solve Turkey’s over-reliance on portfolio inflows, which financed nearly 20% of the 7.9% of GDP first-quarter current account deficit and over 50% of last year’s 5.5% deficit. Controls or no controls, descent into recession is likely; internal and external policy will determine the pace.

Impacts

- A firm Turkish-Qatari alliance -- Qatar pledges 15 billion dollars of investment -- will aid investor confidence.

- Turkish borrowers owe Spanish banks over 80 billion dollars , French banks over 35 billion and Italian banks over 18 billion.

- Erdogan may seek to use the crisis to move the economic system away from a Western model towards an Islamic one.

- China will be eyeing investment opportunities but geopolitical risks could make officials cautious.

- Vulnerable emerging market currencies are down, but better buffers mean the risk of widespread contagion is lower than 10-20 years ago.

See also

- Turkey could loosen monetary policy prematurely - Mar 6, 2019

- Turkey’s import plunge signposts much weaker GDP ahead - Nov 12, 2018

- Turkey must reform structurally to meet fiscal targets - Oct 22, 2018

- Spain faces economic challenges despite recent growth - Oct 17, 2018

- Upcoming events could worsen Turkey’s economic outlook - Oct 11, 2018

- Crisis will cut profits, add risks for Turkish banks - Sep 17, 2018

- Tighter money conditions could cause multiple shocks - Aug 24, 2018

- India’s growth will be fragile - Aug 23, 2018

- Turkish finance ministry fails to convince investors - Aug 17, 2018

- Prospects for the global economy to end-2018 - Jun 1, 2018

- More graphic analysis