A China crisis is bigger systemic threat than markets

China’s influence on the global real economy is a bigger risk than events in fragile Italy, Turkey and Argentina

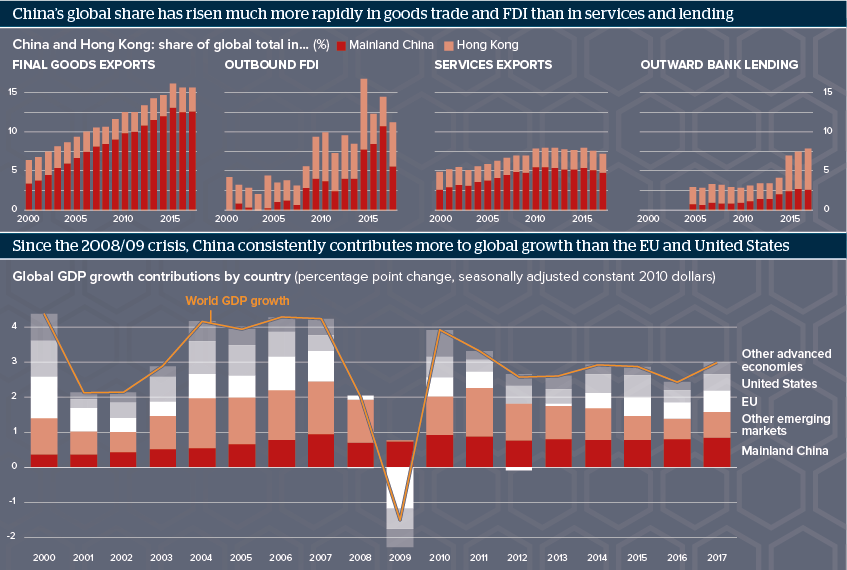

Source: IMF Direction of Trade Statistics, IMF Coordinated Direct Investment Survey, Bank for International Settlements

Outlook

Concerns about China’s financial stability are rising -- the Shanghai composite stock index has fallen by over 20% (in dollars) this year, twice as much as emerging markets on average.

This pales in comparison to Turkey and Argentina’s financial market movements but China is crucial to world economic activity, accounting for over 15% of goods exports, over 10% of foreign direct investment (FDI) and nearly 8% of global lending and services exports. Consequently, it impacts real activity more than finance.

China contributed 29% of global growth in 2012-17, twice its 1996-2007 contribution. Its commitment to 6.5% growth to 2020 means it is likely to contribute more than 30% in 2018-22.

Impacts

- Central and South Asia received 20% of China and Hong Kong’s 2016 FDI, double 2009; East Asia gets 62%, leaving these regions vulnerable.

- In 2011, China overtook IFI and development bank lending and is now lending almost three times as much; the gap will widen.

- Chinese tourists spent 115 billion dollars on trips abroad in 2017; weaker spending ahead would hit lead destinations Thailand and Japan.

- China’s US treasury holdings are rising; the security they offer means the authorities are unlikely to sell just to rile the United States.