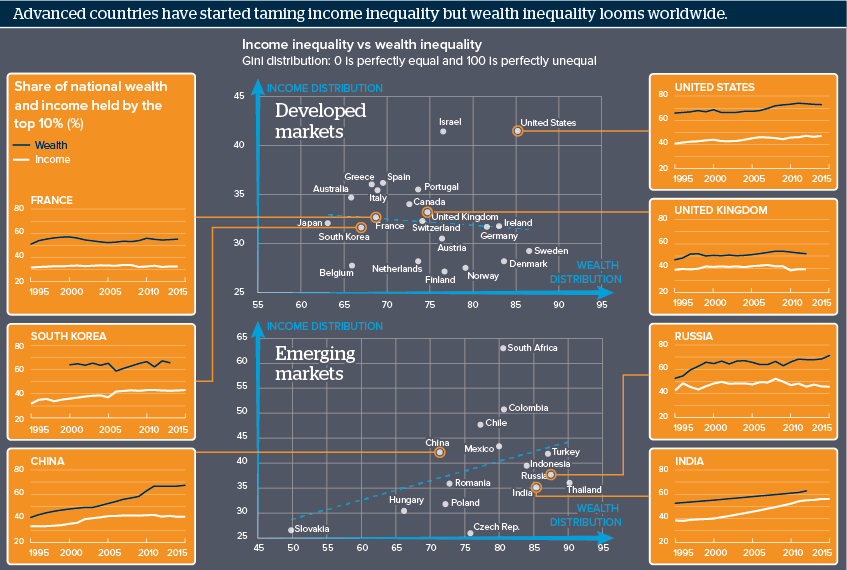

Widening wealth disparities will drive populist voting

Wealth is more unequal than incomes; countries with stable or falling income inequality will increasingly address wealth

Source: Rosatom; Income Gini coefficients from the World Bank, wealth Gini coefficients from the 2018 Credit Suisse Global Wealth report, top 10% wealth and income shares from the World Inequality database.

Outlook

Wealth inequality is surging across advanced, emerging and former communist countries, in contrast to income inequality, which eased from a global Gini coefficient of 68% in 2005 to 65% in 2016 (nearer 100% is more unequal).

The top 10% hold more than 70% of Russian and US private wealth and over 50% in the United Kingdom, India and France. However, public wealth is plunging as a share of these countries’ GDP, reducing the resources with which governments can invest in identifying wealth holders and planning politically palatable redistribution.

Research into the relationship between wealth and political preferences confirms that the less wealthy favour populist policies, signalling more nationalist voting ahead.

Impacts

- Research using seven countries’ house prices and voting to proxy wealth and preferences suggests weaker property growth fuels populism.

- Houses can proxy wealth but logging other data better will augment estimates -- 28% of US wealth is houses; in France and China, over 60%.

- Technology will be increasingly used to help record wealth holdings; for example, drones are used to check property sizes in the Caribbean.

- The relation between wealth inequality and political preferences signals populist voting, but polarisation hinders agreeing redistribution.

See also

- Large US household balance sheets pose macro risks - Oct 13, 2021

- The path of US inequality rests on political progress - Jun 16, 2021

- Modi will look to philanthropists in COVID-19 fight - Apr 30, 2020

- US wealth tax gains may be more marginal than radical - Nov 12, 2019

- Taxing capital over income and spending needs momentum - Jun 11, 2019

- US policy has the flexibility to aid inflexible places - Feb 25, 2019

- 2020 Democratic candidates will shift US fiscal agenda - Feb 14, 2019

- Connectivity and training could increase EU equality - Jan 24, 2019

- More graphic analysis