Taxing capital over income and spending needs momentum

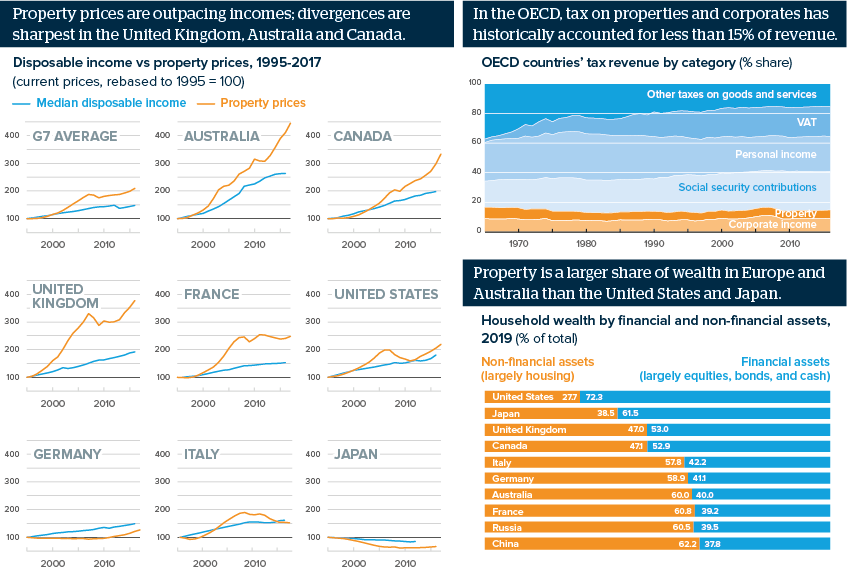

Wealth is more unequal than income; tackling property prices and tax is more crucial for some nations than others

Source: OECD, World Inequality Report, Credit Suisse Wealth Report

Outlook

Shifting the tax burden from labour income to capital and capital gains is crucial to addressing wealth inequality. Policies now gaining popularity to tackle inequality largely focus on incomes: employment prospects, progressive income taxes, social security and collective wage bargaining.

Research for seven major countries confirms that the less wealthy favour populist policies, signposting more nationalist voting. Property is a concern in countries where prices are far outgrowing incomes, but taxing property values and transactions provides little revenue.

Just 6% of OECD tax revenue is from property, unchanged since 1980. Less than 10% is from corporates, also unchanged over time -- illustrating the difficulties involved in taxing capital.

Impacts

- US Democratic contenders for 2020 are calling for wealth taxes, but the popularity of 2017’s tax cuts suggests a losing battle.

- In Europe, France last year became the ninth country since 1990 to eliminate its wealth tax; US proposals are learning lessons from this.

- UK Conservative leadership candidate Michael Gove suggests scrapping value added taxation, but taxing spending will remain globally popular.