Differentiated approach aids emerging market assets

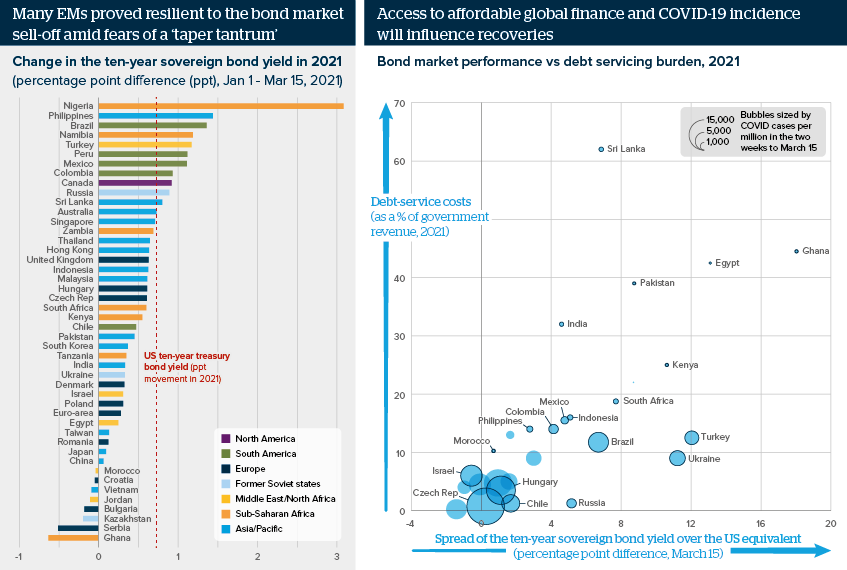

US GDP upgrades are fuelling price fears and a bond market sell-off, but investors are differentiating more between EMs

Source: Thomson Reuters Datastream, IMF World Economic Outlook

Outlook

Many emerging market (EM) bond markets have outperformed advanced markets, but debt service costs weigh more heavily on EMs. Debt service takes more than 10% of many EMs’ government revenues, crowding out spending on social services, education and infrastructure. External deficits were the key target in the 2013 ‘taper tantrum’. Fiscal sustainability is now crucial.

Brazil and Turkey are likely to raise interest rates this week; Russia, Mexico, South Africa, India and Indonesia will ponder increases. Brazil, Mexico, South Africa, Russia and frontier markets including Nigeria are unlikely to achieve faster nominal GDP growth than their cost of borrowing. Some EMs will recover strongly, but some risk a vicious circle of higher funding costs and lower GDP.

Impacts

- Mild growth or recession in Brazil and South Africa exert a large regional drag due to the weight of their demand for neighbours’ exports.

- Nearly 44% of Turkey’s external debt matures in 2021, and its recent return to economic orthodoxy will be key to keeping investor support.

- Indian banking is fragile, but firm growth and relative bond market depth reduce the risks; many EMs find domestic fundraising trickier.

- The G20 supports a new round of IMF special drawing rights; initiatives may be trialled to distribute more of this to lower-income states.