Must read

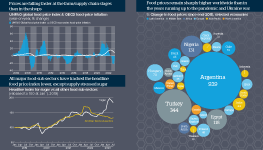

High food costs will strain households well into 2024

The UNFAO global food price index has fallen for 17 months but food prices remain far higher than 2013-20

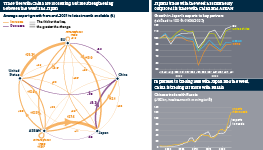

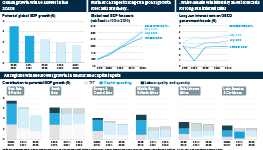

Lower rates will return, amplify and raise challenges

New data over six centuries suggest the trend for lower rates will resume along with the associated policy challenges

AI may take decades to lift economy-wide productivity

It took a generation for full electrification benefits to raise economy-wide productivity; the same may be true for AI

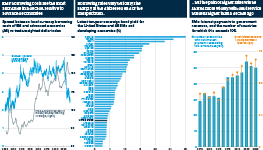

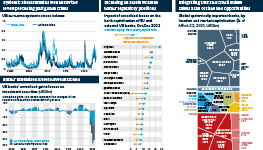

Long commercial property downturn has lasting impacts

Refinancing risks are rising in commercial property; long-run structural changes are hitting office and retail hardest

Fed balance sheet reduction should progress smoothly

The Federal Reserve has reduced its balance sheet by around USD0.8tn since April 2022 but ‘plumbing’ problems are a risk

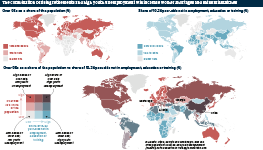

Demographic-focused policies would raise global growth

China says its population shrank in 2022 while Japan and Europe have raised fears about the impacts of ageing

Tight US job market will keep monetary policy tight

The US labour market is slowing very gradually, keeping wage growth as a key concern for the Fed

Weaker finance context would test all emerging markets

Macroeconomic stability, policy credibility and dollar weakness are improving prospects for most emerging markets (EMs)

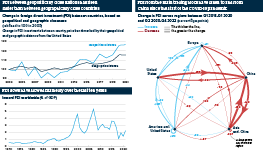

Near- and friend-shoring markedly alter trade flows

The United States, Europe and Japan are trading more together and less with China, which is trading more with Russia

Renewed rate rises raise risk of more financial shocks

More rate rises are likely next week from the US Federal Reserve and the ECB

European and US labour productivity has weak momentum

The long-term downward trend in euro-area and US productivity gains is worrying for future GDP growth prospects

US corporate debt distress will rise

A total of 236 US firms filed for bankruptcy in January-April 2023 and filings will rise in the rest of the year

ECB balance sheet reduction raises fragmentation risks

The ECB balance sheet reduction so far has been modest but the pace of the quantitative tightening will rise from July

Strain in emerging market (EM) debt to stay selective

Higher interest rates globally have not yet had a sharply negative impact on many EM sovereigns

Worker shortages and skills mismatches will hit growth

High youth unemployment and rising worker retirements are straining labour markets and productivity

Downside risks to China’s growth target are mounting

China’s leaders know that weak second-quarter growth means more policy action will be needed this year

Prospects for the global economy in H2 2023

Global economic activity will worsen as services slow, with the downturn relatively mild but potentially prolonged

The central banks face an increasingly complex dilemma

Central bank pressures are rising and uncertainties over bank solvency, interest rates and inflation will reduce growth

Weak long-run growth raises risks to the world economy

Global GDP will grow by less this decade than the past unless there is a surprise uptick in productivity

Market turbulence and rising rates weigh on EU banking

Despite high prudential ratios and advantages over their US counterparts, EU banks are not immune to a confidence crisis

Globalisation evolves as FDI and supply chains shift

Friend-shoring is outstripping near-shoring in the remaking of supply chains

Bank regulations cannot prevent a crisis of confidence

Recent events show that higher rates and crashing confidence can push well-capitalised banks to crisis quickly

SVB failure spells contagion but not systemic risk

Major global tech lender Silicon Valley Bank and crypto lender Signature Bank have collapsed in quick succession

The ECB will face a conundrum over its monetary policy

After the latest ECB meeting, investors shifted to believing that tightening might end soon, but this may be optimistic

Dramatic rise in yields raises appeal of global bonds

Bonds are back, attracting increasing investor attention in contrast to more volatile equities

Cost-of-living strains curb Europe’s near-term outlook

Cost-of-living pressures will constrain economic activity in Western Europe in 2023/24 but will ease in the medium term

Key Asia-Pacific trade pact will gain momentum

The Regional Comprehensive Economic Partnership is now in force for 13 out of its 15 signatories

Fed's 2022 rate rises to bite fully this year

Monetary policy works through several channels and has been key to official authorities influencing activity recently

Global minimum tax on corporate profits is going ahead

A global minimum tax on corporate profits is being implemented but market country taxation is on hold