Prospects for the US economy in 2021

The risks to the outlook in the first half of 2021 are weighted to the downside but vaccines may fuel a V-shaped rebound

New COVID-19 infections reached a new daily record of 198,633 on November 20, clouding the near-term economic outlook. Ensuing restrictions cast doubt on the prospects for sustaining the impressive third-quarter GDP rebound in the next two quarters. The recovery of employment and consumption could be reversed. Congress's failure thus far to extend economic support beyond 2020 is a looming threat.

What next

Consumption accounts for around two-thirds of GDP and will drive the near-term decline in GDP. A compromise stimulus package is likely, but the timing and focus is uncertain, and in size it will be considerably smaller than the Democrats' preferred USD3.4tn. Sustaining jobs and viable businesses in the first half of 2021 will allow a more vigorous rebound thereafter, as vaccines permit a full economic reopening.

Subsidiary Impacts

- Extended remote working will have long-term effect, fuelling real estate activity as many workers seek larger homes from which to work.

- Travel related firms will struggle as the Center for Disease Control advises no travel to at least end-2020; most US travel is domestic.

- Intra- and intercontinental supply chains will remain under stress due to full lockdowns in parts of North America and Europe.

- A fragile, uneven initial recovery may promote discussion of new broad-based taxes among federal and state decision-makers.

Analysis

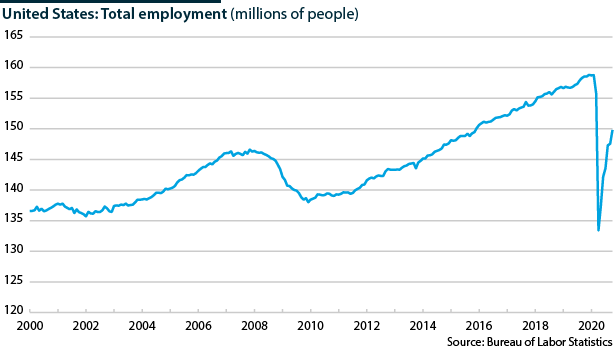

The economy has recovered steadily, albeit unevenly, since late May. Employment dropped by over 25 million (mn) between February and April, to 133.4mn, and the unemployment rate jumped to 14.7%. By September, almost 150mn people were working.

However, another wave of COVID-19 cases is underway, and many parts of the country have stay-at-home orders in place, as well as restrictions on economic activities for which distancing is difficult. There has been notable progress on vaccines to protect against COVID-19, but none is expected to be widely available for several months. Before this, employment will fall again, though not as far as in April.

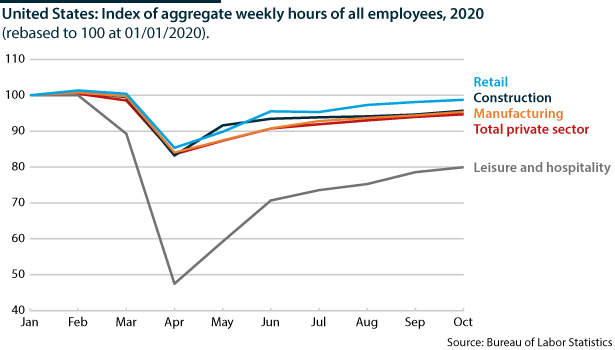

Sectoral performance

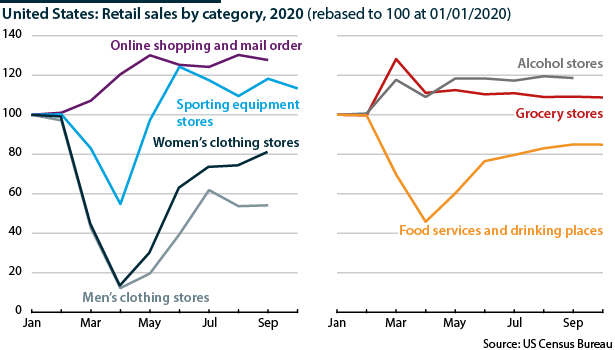

Some industries and workers, such as information and communications technology, made a smooth transition to remote working. Other industries, including manufacturing, food processing and food retail, have adopted new standards to work onsite but face local closures in case of virus outbreaks (see UNITED STATES: GDP and jobs recovery to vary by region - October 21, 2020). Some sectors, such as travel and hospitality, remain severely disrupted; online services continue to boom.

Fiscal and monetary policy

Federal Reserve (Fed) monetary policy has been clear, cutting interest rates to zero and providing forward guidance that rates will stay close to zero until well after the pandemic (see UNITED STATES: Fed move to keep rates lower for longer - September 21, 2020). The Fed has set up various lending facilities to help firms, states and municipalities that might otherwise have problems accessing funding. Further monetary stimulus is unlikely because the Fed sets policy to work for a few quarters into the future, and expectations are high that vaccination will be well underway by then.

In March the CARES Act was signed into law and provided up to USD2.2tn to support the economy via direct payments to adults and children and forgivable loans to small businesses. The Democratic-led House of Representatives passed the follow-on HEROES Act in May, costed at USD3.4tn initially, but the Republican Senate preferred a USD500bn package.

Rather than make major concessions to achieve a compromise, the Democrats opted to wait in the hope of winning the presidency and Senate in the November 3 elections. Unless they can beat the odds and win both of Georgia's run-off Senate races, this will not happen (see PROSPECTS 2021: United States - November 20, 2020). The likelihood is that compromise will be reached, but for a package significantly smaller than USD3.4tn, which is equal to roughly 15% of 2019 GDP. Already House Democrats have cut the headline cost by USD1.2bn in an effort to reach agreement.

Bipartisan compromise is likely to herald a stimulus bill of some shape and size

Treasury Secretary Steven Mnuchin is attempting to end various Fed programmes authorised by the CARES Act at the end of 2020, but this could create complications for the incoming administration of President-elect Joe Biden. Forcing the Fed to return unused funds to the Treasury would require the Congress to reapprove the transfer of the funds back to the Treasury, and would give Republican Senators, who favour a smaller stimulus bill, additional leverage in negotiations. The dispute is likely to persist and it highlights the potential for the outgoing administration to limit Biden's room for manoeuvre as president, before he takes office.

GDP growth

The outlook is poor for the first quarter of 2021 and perhaps also the second quarter, with recurrent COVID-19 outbreaks and local shutdowns raising unemployment and reducing spending. When the House and Senate reach agreement on a new aid package, how large it will be and which entities it will support, are materially important. Assuming that vaccines begin to be distributed in the first half of 2021, the economy should recover sharply in the second half of 2021 as people return to work and disrupted sectors return to full activity.

Consumption

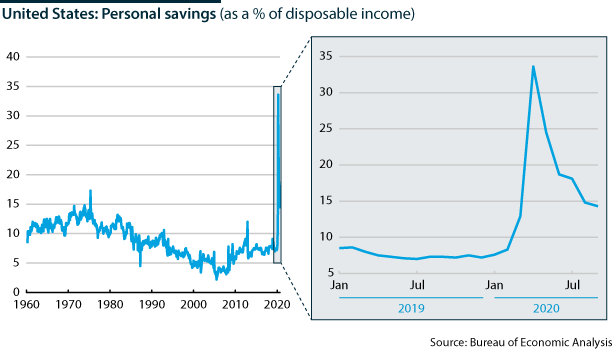

Personal savings have surged and this will fuel a strong recovery in some sectors

Personal savings surged for two reasons: the CARES Act distributed payments directly to adults and children, and opportunities for travel, hospitality and arts and recreation plunged. Savings had long been thought to be too low, with consumers running up large amounts of credit card, student and mortgage debt relative to income, but this year the personal savings rate jumped from the historic 5-10% trend to over 30% in April. It was still 14% in September.

Various kinds of spending that have been feasible during isolation have jumped in recent months, including on home improvement. When the virus disruption is eliminated or at least eases substantially, spending on restaurants, travel and holidays will rebound. Spending on clothing, entertainment and arts, leisure and recreation is also likely to pick up.

Investment

The fate of small businesses, long the engine of US job growth, will be crucial (see UNITED STATES: Retailers that can adapt will flourish - September 15, 2020). Many more local businesses such as restaurants, coffee shops, laundries and small retailers will close before the pandemic ends. If the next stimulus bill offers more support for small firms, this will help them survive. If there is little further support for these firms then national chains, with greater cash reserves and better access to capital, may increasingly take their place. Businesses in sectors that have seen demand grow during the pandemic have built up large reserves and could flourish in the recovery, boosting innovation and investment into 2022 (see UNITED STATES: Tech bubble not the highest market risk - September 30, 2020).

Outlook

The strength of the economic recovery will rest not only on the timing of mass vaccination, which will allow a full economic reopening, but also on how many jobs and productive firms survive the lockdowns. If the economy recovers strongly in the second half of 2021, and fairly evenly across sectors, the Fed could face pressure to consider interest rate rises and balance sheet unwinding within months.