Prospects for the global economy to end-2016

Easing recessionary conditions in some emerging economies will gradually improve global growth

Updated: Oct 21, 2016

Markets will wait for December for ECB QE decision · All Updates

Global growth could accelerate in the second half of 2016. Some emerging economies are facing better conditions thanks to the weaker dollar and some rebound in commodity prices, while others remain in recession. US growth slowed in the first quarter, while Japan's government just avoided a relapse into recession. Euro-area growth is robust compared to its recent trends, but cannot be relied upon to provide much support for the rest of the global economy.

What next

The nervous global mood and the difficult transition to lower commodity prices argue against a strong recovery. However, there is reduced potential for shocks to disappoint expectations, as excess optimism has been curbed. The global economy should be more resilient to downside risks. Governments could encourage investment, taking advantage of still-low interest rates. A modest rise in yields across the main developed regions is likely; commodities have recovered somewhat, and the inflation outlook has improved, also supported by upcoming positive base effects.

Strategic summary

- The ECB's latest easing round may not have delivered a weaker euro but, even at current exchange rates, member countries will be more competitive than they were a few years ago.

- China's growth is on track to meet official targets; concerns about capital outflows and currency devaluation will ease further.

- The main risks are 'Brexit' and the US presidential election, together with the potential for renewed energy market volatility and escalating regional conflicts.

- Even after the recent repricing, the tightening discounted by the Fed Funds 'futures strip' appears conservative compared to the US growth and inflation outlook.

Analysis

In volatile conditions, it is difficult to identify trends. Extrapolations of past trends and 'mean reversion' are not always reliable guides to the future. Nor are new or unproven theories, such as 'secular stagnation' (see INTERNATIONAL: Monetary tightening risks stagnation - June 10, 2014).

Until strong new trends are visible, the global economy will be susceptible to continuing volatility.

Uncertainty makes economic agents care more about the short term, adding to the fear generated by drift, lack of direction and critical signposts.

One frustrating aspect of current trends is the global trade weakness, which for many years has been a key factor behind economic growth (see INTERNATIONAL: Trade protectionism hurts global growth - January 14, 2015).

World trade is unlikely to spark a global growth surge this year and may stay lacklustre in 2017. Manufacturing exports are suffering from weak demand, excess supply and a lack of new products and markets.

Commodity demand keeps growing and consumption has accelerated in some countries, but medium-to-long-term trend growth is modest. Spare capacity will fall only gradually, limiting a generalised price rebound.

United States: sluggish, but improving growth

0.8%

Annualised quarterly US growth in first quarter

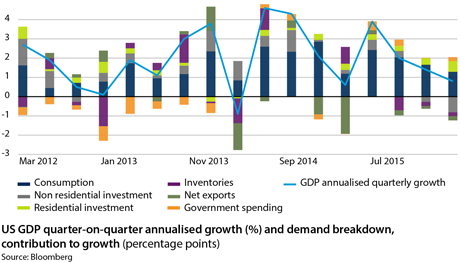

GDP growth slowed to an annualised quarter-on-quarter rate of 0.8% in the first quarter of 2016 from 1.4% in the previous quarter. This is partly due to 'residual seasonality' effects, which tend to underestimate growth every first quarter.

High-frequency data for the second quarter have been stronger. The economy is likely to rebound to annualised 2.5% growth in April-June, and then moderate to 2.2-2.3% in the second half. The full-year GDP expansion should be 1.9%.

A similar pace of growth is likely in 2017. Despite such relatively tepid growth, the labour market should get closer to full employment, driving up wage and inflation pressures.

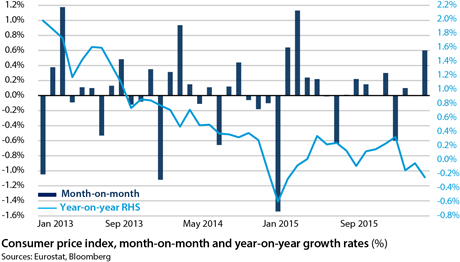

Past commodity price weakness has contributed to keeping inflation low. Absent a renewed sell-off, positive energy base effects (the consequence of abnormal levels of inflation in a previous period that distort headline inflation numbers for the most recent period) will show up, allowing headline inflation to accelerate.

Core inflation should also trend higher, driven by service prices, whose yearly growth has been running above 2.5% for more than a year. The Federal Reserve (Fed) has recently appeared to have more confidence in the economic outlook.

The latest Fed officials' remarks and the minutes of the April Federal Open Market Committee (FOMC) meeting have put a June rate hike back on the table.

Most participants share the view that it will be appropriate to hike rates if growth accelerates, the labour market tightens further and inflation progresses towards its 2% target..

The likelihood of a June hike as discounted by Fed Funds futures has increased to 30% from 4% on May 16. The probability of a July hike has also increased to 53.8% from 19.0% over the same period.

Two rate hikes in all are likely this year.

Europe: waiting for UK referendum

1.5% and 1.6%

Expected euro-area GDP growth in 2016 and 2017, respectively

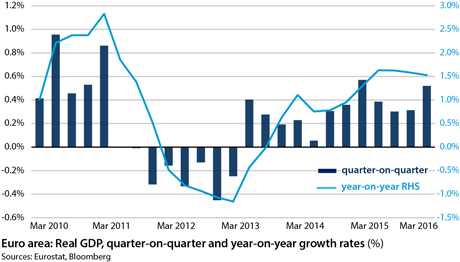

Euro-area GDP rose by 0.5% in the first three months of 2016, from 0.3% in the fourth quarter of 2015. Even this lacklustre pace is unlikely to be sustainable, as it was boosted by special factors such as calendar effects and a mild winter (see EURO-AREA: Low growth supports case for ECB action - February 16, 2016).

The full-year 2016 GDP growth rate should be 1.5%. A similar pace is likely in 2017. Europe's exposure to weak world trade argues against stronger growth.

As in the United States, energy base effects will soon be positive, favouring an inflation rebound.

The ECB is engaging in the new measures announced in March, focusing more on getting credit flowing again to the real economy rather than on weakening the currency ('credit easing').

This should support the recovery and allow a gradual reduction in the labour market slack, easing the downward pressure on yields from the purchasing programme.

Risks relate to 'Brexit' and turbulence of financial flows (see UNITED KINGDOM: 'Brexit' could hinder long-term growth - April 11, 2016).

A vote to leave would lead to protracted negotiations and resetting of trade relationships, which could weigh on financial markets, holding back credit expansion, investment and growth in the United Kingdom.

Adverse spillover effects on the rest of the EU are likely, adding to euro-area banking woes (see ITALY: Atlante will not be long-term panacea for banks - May 16, 2016).

Weaker European growth and possibly a UK recession may affect both export opportunities and financial flows.

Meanwhile, a steadily growing EU would support growth and stability in the rest of the world.

Asia: hit by weak world trade

The manufacturing shift from the advanced economies to lower-cost emerging markets (EMs) has benefited Asia but also exposed it to the risk posed by reliance on the rest of the world's demand.

As the latter has slowed, Asian producers have faced stiff competition, excess capacity and uncertain prices for many exports, which feed into a weakened business outlook, finances and job prospects.

Some governments have increased their spending, or can do so, by financing infrastructure projects.

In Japan, this action has already been spurred by the need to rebuild earthquake-affected areas. Public spending helped avert recession in early 2016 (see JAPAN: GDP volatility obscures positive trends - May 20, 2016).

China, Japan and South Korea are exposed to harsh competition in manufacturing trade and the need for new product launches, while newcomers, such as Vietnam, can offer lower costs in light manufactures.

China

Through the Asia Infrastructure Investment Bank and other financing channels, China aims to launch a long-term infrastructure build-out across Eurasia with its 'One Belt, One Road 'project (see ASIA: Slowdown has upside for investment-hungry Asia - January 26, 2016).

This will take time to start up, decades to implement and may only ever be completed partly, not wholly.

China's growth was strong in the first quarter, at 6.7% year-on-year (see CHINA: Rebalancing continues, but debt risks rise - April 18, 2016).

However, it was mainly driven by traditional growth sources -- investment and exports -- pausing the rebalancing efforts towards internal consumption and services temporarily..

The monetary and fiscal stimulus delivered will support growth further in the short term. However, as the economic rebalancing progresses, GDP growth may slow over the next years, to 6.0-6.5%.

India

India is growing faster than China, helped by its relatively low dependence on manufacturing trade, although the government is aiming to boost India's presence in global manufacturing.

Economic activity in the financial year to March 2017 is likely to fall short of the government's optimistic projections of 7.0-7.5% growth, itself down from 7.6% in 2015-16.

Further fiscal consolidation will impede the government's stated goal of developing infrastructure, especially smart cities, full electrification and bullet trains (seesee INDIA: 2016-17 growth will not meet optimistic budget - March 2, 2016.

Other EMs

The recession that has hit Russia and Brazil over the past couple of years is bottoming out. Without renewed turbulence, a recovery could emerge by year-end, but political factors remain in play in both countries.

Growth drivers could be different from previous ones, with less dependence on commodity markets.

Russia

The effort that Russia has made to improve import substitution in sectors such as agriculture and the key areas of manufacturing and services could support growth and employment, alongside any acceleration in the traditional revenue and spending drivers, mainly energy exports.

However, Central Bank predictions of a modest return to growth in the second half of this year may ease both the urgency for reforms and pressure for severe budget cuts, and strengthen Kremlin advocates of growth stimulus through state spending see RUSSIA: Reformer's promotion unlikely to bring change - May 10, 2016.

Brazil

The government of interim President Michel Temer is likely to pursue economic orthodoxy but needs Congressional approval for unpopular reforms, including pension reform, that may quickly unravel Temer's national unity coalition, if it can no longer coalesce around impeachment proceedings against President Dilma Rousseff (see BRAZIL: Temer would seek orthodox policy turn - April 18, 2016.

Middle East

Iran should benefit from its re-entry into the global economy, while countries such as the United Arab Emirates will reap benefits from past efforts to diversify and grow sectors such as logistics and financial services.

Saudi Arabia is just embarking on diversifying, including plans to privatise Saudi Aramco. This will provide a new source of cash inflow (see SAUDI ARABIA: IPO holds key to diversification plans - May 11, 2016).

Bond markets

Risk aversion intensified in the first quarter, as concerns over China's slowdown and a deeper contraction in US manufacturing weighed on sentiment.

Renewed commodity weakness dampened inflation expectations, undermining confidence in the effectiveness of monetary policy (see INTERNATIONAL: Monetary easing efficacy is decreasing - May 3, 2016).

As a result, bond yields dropped across the board. From March, a strong policy response in China and a moderate pick-up in global manufacturing activity helped abate growth fears and risk assets rallied back.

This positive sentiment had no impact on global rates:

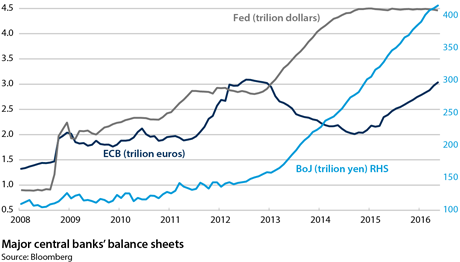

- The ongoing bond purchase programmes by the ECB and the Bank of Japan (BoJ), together with further official rates cuts, kept yields low.

- In the United States, the dovish Fed stance led markets to price out any rate hike until a few weeks ago.

- The relative attractiveness of US yields compared with other advanced economies enticed international investors to buy Treasuries, containing any upward pressure on long-term yields.

In Japan, some fiscal and monetary stimulus is likely over the next few months, supporting the economic outlook.

United States

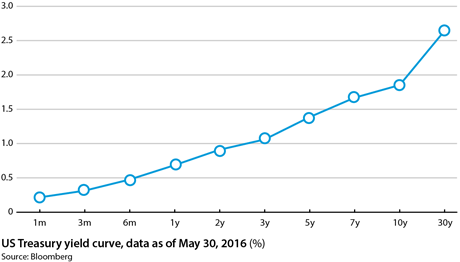

With no external shock, the 50-basis-point (bp) cumulative hike currently discounted by markets over the next 18 months underestimates the actual tightening deliverable by the Fed.

2.5%

Likely ten-year Treasury yield at end-2016

Some risk premium is likely to resurface on the Treasury curve. The ten-year Treasury yield could rise to 2.5% at end-2016.

Euro-area

The ECB's efforts to reflate the euro-area economy have been hampered by:

- the oil price collapse, given the large share of the energy sub-component in the euro-area CPI basket;

- the pause in the euro depreciation; and

- the large output gap.

The ECB purchase programme is helping contain core yields despite improving sentiment. From June, part of the incremental purchases will shift to corporate and regional debt, alleviating downward pressure on core government bond yields.

The ECB's credit easing measures (corporate bond purchases and new long-term refinancing operations) should support domestic demand and help rebuild some inflation premium into the curve.

0.6%

Likely ten-year Bund yield at end-2016

Ten-year Bund yields could rise to 0.6% by end-2016. Peripheral spreads are likely to remain above 100 bp. Peripheral yields (chiefly Italian and Spanish bond yields) could rise by 20-30 bp from current levels.

Japan

With almost no room left for further monetary easing, the burden of reviving the economy increasingly lies on fiscal policy.

The Abe government is working on a new stimulus package aimed at boosting growth, while the consumption tax hike initially planned for April 2017 looks set to be postponed until October 2019.

This, together with some rise in inflation and global yields, should rebuild risk premium into the Japanese curve. The ten-year yield is likely to return positive by year-end, at around 0.05%.

EMs

EM government bond yields will not decouple from rising US rates. Anyway, the impact of the Fed's tightening will be mild. Fears of a Chinese hard landing have receded and volatility in forex markets decreased consequently.

Corporate bonds

The US corporate bond market remains risky. Stirred by ongoing stress in the energy sub-sector, defaults are rising in the US credit market.

US corporate leverage is increasing to levels last seen before the 2008 financial crisis to finance record equity buybacks.

In Europe, the new set of ECB measures should underpin corporate bonds, especially in the non-financial sector, allowing a further spread narrowing in the second half of 2016.

Currencies

Monetary policy will prove a key driver for global forex markets in the second half of 2016.

Dollar

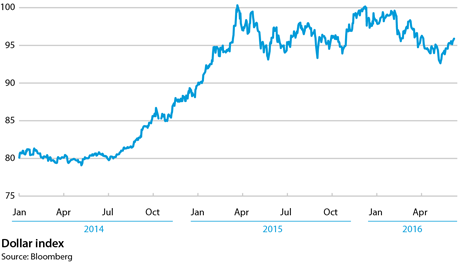

The strengthening dollar trend halted in early 2016, owing to the dovish Fed stance. Markets, positioned for further greenback's strength, were caught off guard.

Since March, markets have reversed position on the dollar. Over the next few months, the divergence between the Fed's and other central banks' policies should resume. The former may hike rates further, while the ECB and the BoJ could ease.

The dollar is likely to strengthen again, albeit at a slower pace, because of an informal agreement at the February G20 meeting to refrain from competitive devaluations. Central banks are shifting their policies towards credit easing.

Euro

Despite the ECB's easing, the euro strengthened in early 2016, frustrating both the Bank and investors. Among other reasons, the Fed paused on its normalisation path, while the ECB's December meeting disappointed investors, as it did not deliver an easing package as bold as expected.

In the second half of 2016, the euro should depreciate mildly towards 1.08 against the dollar:

- Recent FOMC dynamics suggest that a resumption of the normalisation process.

- From June, the pace of the ECB's balance sheet expansion will accelerate.

Euro-dollar parity remains an ambitious target, as stability in forex markets has become a target of global monetary policy.

Sterling

In early 2016, the pound has been tracking changes in the polls for the UK referendum on EU membership. The vote outcome will affect the currency, making any prediction difficult.

Macroeconomic data are deteriorating, and housing activity is slowing. Capital inflows to finance the record current account deficit will decelerate, weighing on the currency.

The pound could end the year at 1.40 against the dollar if the United Kingdom stays in. In the event of an 'out' vote, it could hit 1.30.

Yen

The BoJ's efforts to depreciate the yen have backfired. The market reacted poorly to the negative rates decision at end-January. The yen has appreciated since then.

The weakness of growth and inflation despite the central bank's large easing programme has dented the BoJ's credibility. As its ownership of Japanese government bonds approaches 50% of the outstanding government debt, the scope to accelerate its balance sheet expansion is limited.

Likewise, after the blow suffered in January, further rate cuts are unlikely. The chance of a weaker yen relies mainly on the Fed's policy stance.

Since the Fed is likely to hike rates soon, the yen could weaken mildly in the second half of 2016 towards 116 against the dollar.